11 Money Tips Every Young Adult and Student Needs to Know

WITH THAT SAID, HERE ARE THE 11 MONEY TIPS EVERY STUDENT AND YOUNG ADULT NEEDS TO KNOW!

Please note that this site contains affiliate links to products or services from third-party websites. Furthermore, we are not financial advisors or tax/credit experts. The information provided is for informational purposes only and should not be considered as professional financial advice. By reading this post, you acknowledge and agree to the full terms of our disclaimer.

Table of Contents

- 1. Find Other Ways to pay for college

- 2. Knowing how to budget is an essential skill

- 3. Paying yourself first is more important than...

- 4. Autopay is your best friend

- 5. take advantage of compound interest

- 6. create financial goals

- 7. start building credit

- 8. It is easy to rack up debt

- 9. The power of investing early

- 10. Be picky with who you work for

- 11. Get the most out of filing taxes

“But remember the LORD your God, for it is he who gives you the ability to produce wealth, and so confirms his covenant, which he swore to your ancestors, as it is today.”

Deuteronomy 8:18 Tweet

Join our Personal Finance group!

Join us in achieving financial stability! Receive a wealth of practical tips, budgeting hacks, investment insights, and strategies to achieve your financial goals!

Find other ways to pay for college

Money Tip #1: Methods to Pay for College

The average cost of tuition in the U.S. is between $11,610-$43,350 and upon earning a bachelor’s degree, students graduate with an average of $31,960-$47,730 in student loan debt.

Remember, these are just averages. If you stay on track, you are likely to pay less in the long run. BUT if you change majors once, twice, three times, you’re looking to pay much more than this. And if you go to school out of state, you’re looking to pay a lot more. Also, keep in mind that tuition does not include required textbooks, school materials, room and board, and fees.

If you are paying for school on your own like I did, scholarships and Federal Student Aid aka FAFSA are a must!

If your parents make good money, FAFSA may not work in your favor. As in, you may still need to pay for expenses out of pocket. Which is why you should…

Apply to every single scholarship your college is offering and that you are eligible for. Apply to scholarships in your hometown and find more scholarship opportunities online. Just google, “scholarships in __(your city)__” or go to BigFuture College Board Scholarship Search where they have a whole list of scholarships you can apply for based on location, gpa, fields of study and more.

And no, you DON’T need to be a straight A student with a bunch of extra curricular activities. Some are offered simply based on need while others just want to know your career aspiration.

Applying for scholarships may take a good amount of your time, but it’s better than coughing up thousands of dollars out of your own pocket.

Aside from scholarships and FAFSA, employers may offer education assistance. Ask your manager if your employment offers tuition reimbursement or free school through a specific university.

There’s many ways you can pay or not pay for college, which I go over in my article: How to Pay for College Everything You Need to Know.

Other Related Article: 11 Financial Tips You Need to Know For College

budgeting is an essential skill

Finance tip #2: Budgeting is an Essential Skill

The secret to financial success isn’t so much about how much you make, rather it’s more about how you manage your money and how much of it you keep.

One person could be making $5000 a month but saving none of it, while another person could be earning $2000 a month and be saving half of it. When you compare bank accounts between the two, who in your eyes would seem richer? The second person!

That is why it’s important to track your cash flow and allocate your funds efficiently based on your income, savings goals, fixed expenses and daily necessities.

Building the habit of managing your money wisely at a young age, will save the future you from facing financial hardships unprepared.

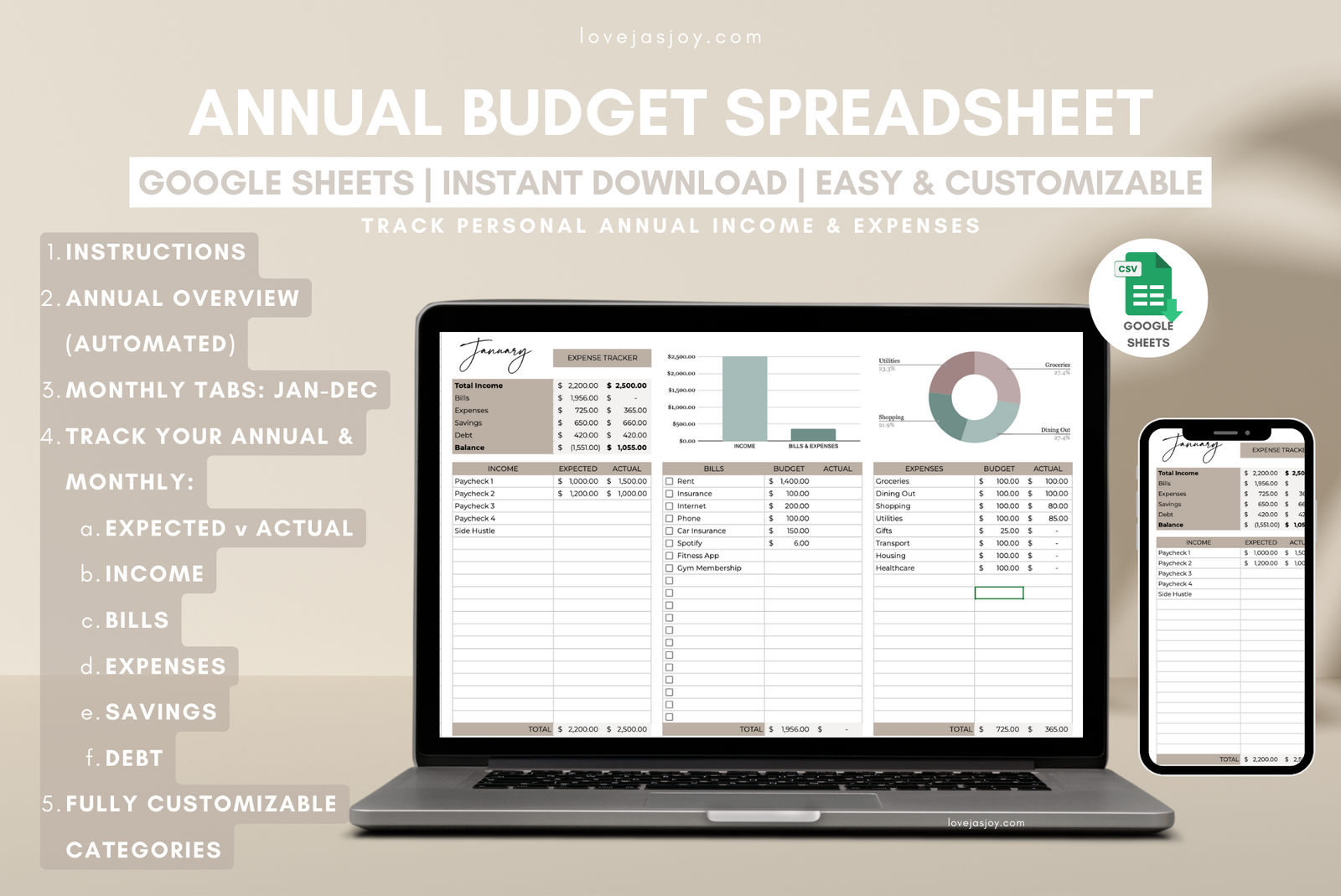

I do have an article about How to Create an Annual Budget That You Can Actually Stick To and have also created a Beginner Friendly Annual Budget Spreadsheet you can use.

Simple Annual Budgetsheet

Budgeting has just been made simple! Use this annual budgetsheet if you are a beginner to budgeting, seasonal or a daily budget person. I use this and I love it!

Paying Yourself First is Important

Money Tip #3: Paying Yourself First > Treating Yourself First

I know you’re probably thinking, isn’t that the same thing? No! It’s not. “Treating” yourself would essentially be rewarding yourself with a purchase.

Yes, you worked hard for your money, so you should be able to spend it as you please. But I am here to tell you that the future “you” is just as deserving as the current you. Think of the “you” who may need it because of an unexpected expense or an emergency.

The easiest, most painless way to pay yourself first is through setting up automatic transfer or direct deposit into your savings account as soon as you get paid.

First, you will want to review your budget, then calculate your discretionary income. Your goal is to save at least 20% of the money you have left after bills and necessities. If you want to save all of it, that is even better.

Discretionary Income: Amount of money an individual or household has left over after paying for essential expenses like taxes, housing, utilities, and food. This remaining income is free to be spent on non-essential items, savings, or investments.

Autopay is Your Best Friend

Finance Tip #4: Autopay is Your Best Friend

Take Advantage of Compound Interest

Money Tip #5: Take Advantage of Compound Interest

If you’ve got money just sitting in your wallet or at home, it’s actually losing value over time. That’s because the average inflation rate in the U.S. is around 3% per year. So every dollar that isn’t earning interest or growing in some way loses about 3% of its purchasing power each year.

This is why you should take advantage of compound interest. Put your money in a high yield savings account or a certificate of deposit that has an APY of at least 3%. Do your research, one bank can offer a much higher rate than another. FYI as of April 2025, rates are as high as 4.66%.

US Current Inflation Rate Chart

Another way to make your hard working money work for you is by investing. Over the last 100 years or so, the S&P 500 has delivered an average annual nominal return of about 10%.

Of course the market is always fluctuating, but investing will always be an amazing way to beat inflation and build wealth over time.

Compound Interest: Interest earned not only on the principal amount but also on the accumulated interest from previous periods. This leads to faster growth of savings or debts over time compared to simple interest.

Inflation: The rate of increase in prices over a given period of time.

Create short and long term financial goals

Finance Tip #6: Create Financial Goals

These goals could range from 1 year to 10 years. Goals change over time, but having a list can be motivating and can keep you focused on your financial journey.

A short term goal could be wanting to save $500 for Christmas spending. A long-term goal could be wanting to save enough down payment to purchase a home in 10 years.

The most important thing to creating goals is making them realistic and manageable. If they are so far out of reach, you may find yourself quickly discouraged.

Yes, dream big, but also have actionable steps to achieve that big dream. Position yourself for success, but stay flexible enough to adjust your goals when necessary.

Related Article: Short Term Financial Goals You Can Achieve This Year

Start Building Credit

Money Tip #7: Start Building Credit

Now, credit is huge! I was blessed enough to start working on this at a young age because my mom was very financially literate and opened up a bank account for me when I was in high school.

This allowed me to build a solid relationship with the bank, so when it came time to apply for a car loan and I had my own stable source of income, I was able to get approved without any credit history.

Not everyone has started off this way and even if so, approval is not guaranteed. So the next big thing would be to apply for a secured credit card in your name alone or apply for a loan with a co-signer.

A secured card is a credit card that requires a cash deposit upfront. This typically becomes your credit limit when approved and is secured in your account as collateral. Secured cards are a great option for building or rebuilding credit. It is important to make payments on time so that it actually helps your score instead of hurting it.

Of course, there’s other alternatives like applying for a loan with your parents as a co-signer but this would require a hard pull on their report and also make them financially responsible for paying the loan.

Why is building and maintaining good credit so important?

Good credit is needed in order to rent out a place, purchase a car, home or apply for unsecured credit lines & other consumer loans. This shows banks, lenders and rental properties you are financially responsible and trustworthy.

To maintain good credit, never be late on your payments, avoid delinquencies, use max 30% of your entire credit line, minimize hard inquiries and keep your debt to income ratio at no more than 50%.

If you reside in the US, create an account with Transunion, Experian and Equifax. You can also get Credit Karma which will show you your credit scores, for free, for Transunion and Equifax.

To learn more about what contributes to your credit score and how to understand your score, I recommend referring to: NerdWallet and CreditKarma.

how to create an annual budget

It is Easy to Rack Up Debt

Finance Tip #8: It is Easy to Rack Up Debt

As a college student it is so easy to rack up debt. This is largely due to student loans! But aside from that, do your best to avoid high interest loans and cards because these are much harder to pay off.

Anything over 7% will eat your wallet for a very long time. I say 7% because the average annual rate of return on investments is 10% nominal, and 7% real return with 3% average rate of inflation.

When it comes to student loans, if you need to apply for private loans, apply for a fixed rate and pay it off as fast as you can. Make more than just your minimum payments because private student loans can have an average rate of high as 16%!

I cry, learn from me! I made the mistake of applying for not just one, but TWO high interest rate student loans! It’s so hard to make a dent in them if I don’t pay a few thousand dollar lump sum every now and then.

For your federal student loans, even if they are deferred, your unsubsidized loans are still accruing interest while you’re in school. If you are working while going to school, start paying toward your student loans on a monthly basis. An amount as little as $5 per account can make a big difference.

Unsubsidized Student Loans: Still accrues interest during the duration of your college attendance, but payments are deferred until 6 months after graduation.

Subsidized Student Loans: Begins accruing interest after 6 months of graduation. Payments are deferred until then.

The Power of Investing Early

Money Tip #9: The Power of Investing Early

You’ve probably heard many finance experts say “The best time to start investing was yesterday, the second best time is today.” This couldn’t be more true! The earlier you start, the more wealth you can build.

More time in the market will always beat finding the “right” time to invest into the market.

Well known primary examples are finance experts Warren Buffet and Ramit Sethi.

Some ways you can invest are through your employer by contributing to your 401k, 403b or TSP. If your employer offers a contribution match, take advantage of it! Contribute 100% of the employer match.

Another way is by opening up a tax advantaged account with a brokerage like Fidelity or Vanguard.

Open a Roth IRA, contribute as much as you can, max out the annual limit if you can, and invest in the right assets based on your age, risk tolerance, and financial goals.

Personally, I have Robinhood (PS sign up with my link & we will both get a free stock of our choice 😉) and Fidelity.

I favor these platforms because I can invest with as little as $1. With Robinhood I can set recurring investments with as little as $1, whereas with Fidelity the minimum is $10 per recurring investment.

Be Picky With Who You Work For

Finance Tip #10: Be Picky With Who You Work For

From my own experience, you want to be picky with who you work for. Your time and your energy is so valuable. Don’t settle for just getting paid.

You want to work for a company that offers benefits like 401k + employer match, paid time off, medical, dental, maternity leave and more.

My own two sense, a job with great benefits is far more worth while than a high-paying job without them.

It’s not just about making money today, but also about long-term stability and making sure your work is helping secure your future.

Now, if the job is a paid internship with no benefits or you find you can learn valuable skills, then by all means! Do what you believe is best for you and your career pursuits :).

There are ways to enroll in health insurance on your own (it would just cost more) and you can invest into a ROTH IRA for your retirement as well.

Get the Most Out of Filing Taxes

Money Tip #11: Get the Most Out of Filing Taxes

Last point, get the most out of filing your taxes! If you’re working and also in school, talk to your parents about letting you claim yourself on your own taxes.

You might get a larger refund doing so, which is always a plus.

Remember when I said to start paying your student loans because debt accrues quickly? Well, paying toward your student loans can also increase your tax refund!

Your lender will provide a 1098E form during tax season IF you made payments, so you can file it as a deductible and maximize your tax benefits.

To further maximize your tax benefits, always keep track of what you donate and the value of the items you have donated, track the costs of your school books & supplies, and keep the receipts for all of these different types of deductions. Digitally or physically.

This is not tax advice though, this is just from my own experience. So please do your own research or speak with a tax expert if you want to learn more about filing your taxes. If you need expert help, I recommend TurboTax. I personally use them every year 😊.

the end...for now

this concludes the 11 finance tips for young adults and students

That was a lot to take in huh? But I can confidently say that these are the essentials to setting yourself up for financial success!

Start taking action on these points today, and you’ll be in such a stronger position down the road. There’s a lot more to learn, but I hope this gives you a solid foundation to build on!

If you want more personal finance tips as student or young adult, send me an email blog@lovejasjoy.com or leave a comment on my related YouTube video of what you would love to learn more about.

Thank you for reading! Have a wonderful rest of your day! And meet you in the next post! 😊

love, Jas Joy

Other Posts You May Like

Related Topics

A Payday Routine: How to Budget Your Paycheck Like a Financial Expert