60/30/10 Budget: How To Manage Your Money Like The Top 1%

HERE is how to manage your money like the top 1% using the 60/30/10 budget rule

Please note that this site contains affiliate links to products or services from third-party websites. Furthermore, we are not financial advisors. The information provided is for general informational purposes only and should not be considered as professional financial advice. By reading this post, you acknowledge and agree to the full terms of our disclaimer.

Table of Contents

“But remember the LORD your God, for it is he who gives you the ability to produce wealth, and so confirms his covenant, which he swore to your ancestors, as it is today.”

Deuteronomy 8:18 Tweet

Join our Personal Finance group!

Join us in achieving financial stability! Receive a wealth of practical tips, budgeting hacks, investment insights, and strategies to achieve your financial goals!

What Is the 60/30/10 Budget Rule?

60 30 10 Budget Formula

The 60/30/10 budget rule is a money management strategy that allocates your after-tax income, aka net income, into three simple categories:

- 60% to fixed expenses (eg housing, bills) needs/essentials (eg utilities, groceries), minimum debt payments

- 30% to personal spendings, dine out, hobbies, entertainment

- 10% to savings, investing, extra debt payments

This money rule allows you to prioritize living within your means while giving you freedom to enjoy your money.

Unlike more aggressive budgeting strategies, the 60/30/10 finance strategy gives you room to enjoy your hard working money today without neglecting your long-term finance goals.

How It Compares to Other Budgeting Rules

60/30/10 vs 50/30/20 vs 70/20/10 Budget Rule

50/30/20 Budget rule

- 50% Bills, Groceries, Necessities, Minimum Debt Payments

- 30% Wants, Personal Spendings

- 20% Savings, Investing, Extra Debt Payments

- Advantages: Well balanced allocation of net income. Only half are going to bills and necessities, which gives you more flexibility to enjoy your money and invest into your future.

- Disadvantages: Might be tight if your cost of living is high or if you spend a lot on groceries or childcare.

- Best Suited For:

- Earners who don’t have a lot of fixed expenses, bills, or debt to pay toward.

- Families who do not have much fixed expenses while paying for childcare.

- Earners who want to be more aggressive with saving and investing.

- Individuals or families who want a more balanced approach to allocating their money.

70/20/10 Budget rule

- 70% Bills, Groceries, Necessities, Minimum Debt Payments

- 20% Personal Spendings, Wants

- 10% Saving, Investing, Extra Debt Payments

- Advantages: Offers more room for bills and necessities. Still comfortably allocating money toward saving and your future. Encourages income growth.

- Disadvantages: A bit more limited on funds toward personal spendings and wants. Can easily feel like you don’t have enough money. May not be aggressive enough for early retirement goals.

- Best Suited For:

- High cost of living.

- Big families who spend a lot on groceries and/or childcare.

- Individuals or families who have already grown their savings or investments to a comfortable amount.

- Individuals or families who still desire to prioritize saving & investing, but also want to enjoy their money even though their bills & necessities are high.

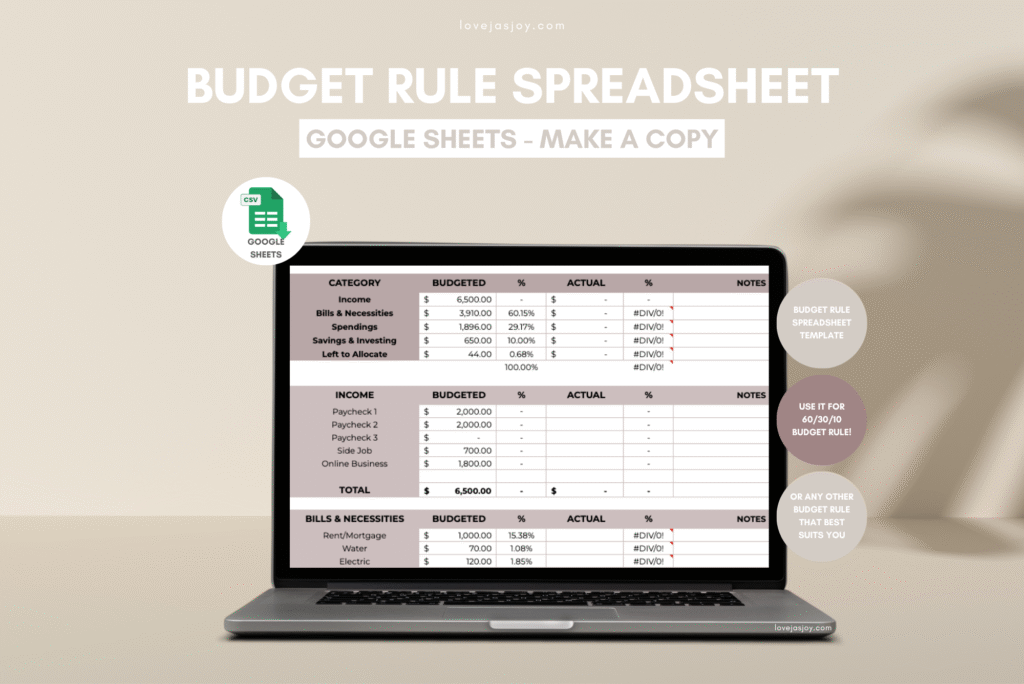

Free budget rule spreadsheet

Just add your email, click send, look out for an email from Love Jas Joy and make a copy of this spreadsheet! 🙂

60/30/10 Budget rule

- 60% Bills, Groceries, Necessities, Minimum Debt Payments

- 30% Wants, Personal Spendings

- 10% Savings, Investments, Extra Debt Payments

- Advantages: More room and flexibility than the 50/30/20 budget rule to put money toward bills and essentials. More freedom than 70/20/10 to spend on personal wants, dine out and more. Comfortable balance between bills, wants, and saving toward your future. Encourages living within your means.

- Disadvantages: Less aggressive with saving and investing. May not be aggressive enough for early retirement goals or specific sinking fund goals.

- Best Suited For:

- Individuals or families who want more of a balance between necessities and personal spendings.

- Earners who already have a good amount of money saved and/or invested.

- Families or individuals who have a greater portion of bills, housing OR debt they need to pay toward.

- Big families who spend a decent amount on groceries and/or childcare.

- Earners who like to enjoy their money on wants, hobbies, entertainment.

Each method has its strengths, but I would say that the 60/30/10 budget rule stands out for its balance and alignment with everyday living and spending behavior.

Ultimately, you know your own bills, spending habits and financial goals, pick for yourself what best aligns with all of the above.

Will the 60/30/10 Budget rule work for you?

60/30/10 Budget Method Best for You?

This money rule for where you allocate your income is a great starting point if:

- You have a steady stream of income and manageable debt.

- You live in a high cost of living area, and your monthly rent/mortgage is within 25-35% of your monthly gross income + have manageable fixed expenses. OR

- Have greater dollar amount of fixed expenses but lower to middle housing cost.

- You want a clear but flexible money structure.

- You’re focused on living comfortably, while still saving.

However, this budget method might not be ideal if you’re trying to pay off high-interest debt quickly and/or desire to save or invest aggressively for early retirement.

A Helpful Money Tip: This budget rule is simply a foundation. You do not need to follow it to the tee if your income, expenses and lifestyle does not allow it. Adjust it to your liking and to match your personal goals and lifestyle!

- For example, your bills, necessities, groceries average out to be 63% of your income per month. You can choose to balance it out to 63/27/10 or 63/30/7. It all depends on your own lifestyle and financial goals.

Annual budget Spreadsheet

What better way to track your income and spendings than a spreadsheet? A simple, beginner-friendly annual budget spreadsheet at that!

Let's Break down the 60/30/10 Formula

60/30/10 Budget Formula

How to Allocate Your 60%

Bills & Essentials

This category covers the non-negotiables, including:

- Rent or mortgage

- Utilities (e.g. water, electric, gas)

- Groceries

- Insurance

- Phone bill, WiFi

- Childcare

- Transportation (e.g. gas, bus fair, train fair)

- Minimum debt payments (e.g. school, car)

The goal, of course, is to keep your daily essentials and living expenses within 60% of your income. If you’re spending more than that, if you have the ability to do so, consider downsizing, budgeting smarter, or increasing income.

Again, as mentioned before, although this rule is 60/30/10, it is okay to NOT be on the dot. But it is important to make up for the difference in the 30% or 10% categories.

How to Allocate Your 30%

Wants & Lifestyle Spending

This is your fun money—and yes, you 1000% deserve it! This 30% can include, but is not limited to:

- Eating out / Dining out

- Travel

- Subscriptions (e.g. Netflix, Spotify)

- Shopping

- Hobbies and Entertainment

The trick is to enjoy your lifestyle without letting it get in the way of your financial progress.

How to Allocate Your 10%

Savings, Investing & Debt Payoff

Even though it’s a smaller slice than your fixed expenses and fun money, this 10% is essential to your future. It is important to use this portion for:

- Emergency fund savings (Recommend putting this into a high yield savings account so it can grow).

- Retirement contributions (Roth IRA, 401(k)).

- Investing in index funds, into brokerage accounts.

- Sinking funds (Vacation, Christmas shopping, Car maintenance).

- Extra debt payments toward credit card, consumer loan etc.

Encouragement for You: Even small, CONSISTENT investments or savings in a high-yield savings account or certificate of deposit compound over time. Starting now is more important than starting big.

Why 60/30/10 Is a Smart Financial Strategy

Why 60/30/10 Is Sufficient to Support Financial Goals

While 10% may not seem like much, it is more than enough to build momentum. This rule helps you practice the habit of saving and investing, which is where millions of people struggle. According to Bankrate, more than half of Americans don’t have enough savings to cover a $1,000 emergency expense!

It is important to think about your future self who might face an unexpected circumstance. Do you want to be scrambling for money? Or putting yourself into debt to cover that expense? I am sure you do not want to be financially struggling ON TOP of emotionally or mentally suffering through an unexpected situation.

With this 60/30/10 budget approach, you can stay on top of your bills, avoid lifestyle inflation, still enjoy your money and ensure your savings grow consistently!

Helpful Money Recommendation: You can still use this budget rule even if you are 1-5% off a category. Just be sure to alter the difference all around or earn more money. You do not want to supplement the difference with a credit card! That is not considered a part of your income!

How to Know When to Adjust It

You may want to shift away from the 60/30/10 budget if:

- Your income increases significantly and you want to save or invest more.

- You’re preparing for a large financial goal (house, car, baby).

- You’re aggressively working to become debt-free OR have already paid off a debt.

- You want to pursue FIRE (Financial Independence, Retire Early).

The key is using this money rule as a starting structure. You do not need to stick to it forever. In fact, you shouldn’t. The percentages should change over time as your financial circumstances or goals change. If anything, you want to be making financial progress.

Final Thoughts on the 60/30/10 budget

The 60/30/10 budget rule is a simple, flexible, and sustainable approach to allocating your finances. You may be new to budgeting or just tired of overcomplicating your cash flow, this money method will help you obtain or maintain control AND actually enjoy your earnings.

Let’s make our way toward financial stability, independence and freedom!

Download/Make a Copy of our FREE 60/30/10 Budget Template to start tracking and managing your money like the top 1%. FYI you can use this template for any other budget rule as well :).

Free budget rule spreadsheet

Get your finances in order! Make a copy of this spreadsheet for free to take a step forward in your financial journey 🙂

love, Jas Joy

Other Posts You May Like

Related Topics

A Payday Routine: How to Budget Your Paycheck Like a Financial Expert