Budgeting in College: Simple Guide on Managing Your Money As A Young Adult

Disclaimer

Please note that this blog post may contain affiliate links to products or services from third-party websites. These affiliate links allow us to earn a commission on qualifying purchases, which helps support the maintenance and growth of this blog. The information provided in this blog post is based our own personal experiences, research, and opinions. We are not licensed professionals, financial advisors, or legal experts. By reading this blog post, you acknowledge and agree to the terms of this disclaimer. For further information, read our full disclaimer page. If you have any concerns or questions, please feel free to contact us.

Learning how to budget properly and effectively is a skill that is essential to a student’s, and young adult’s, financial success. Knowing how to manage your finances can help you stay on track, reduce stress, and make the most of your college/young adult years. In this article, we will provide you with the importance and benefits of budgeting in college, a simple step-by-step guide on how to create a budget, and some tips to help you succeed financially. We assure you, by implementing these strategies, you can take control of your financial situation and set yourself up for success!

WITH THAT SAID, HERE IS “BUDGETING IN COLLEGE: A SIMPLE GUIDE ON MANAGING YOUR MONEY AS A YOUNG ADULT”

Table of Contents

- IMPORTANCE AND BENEFITS OF BUDGETING

- ---CREATING A BUDGET---

- #1 GATHER FINANCIAL INFORMATION

- #2 CALCULATE TOTAL NET INCOME

- #3 LIST AND CALCULATE FIXED EXPENSES

- #4 LIST AND CALCULATE VARIABLE EXPENSES

- #5 SUBTRACT EXPENSES FROM INCOME

- #6 ALLOCATE AVAILABLE FUNDS TO CATEGORIES

- #7 PRIORITIZE SAVINGS: EMERGENCY FUND

- #8 TRACK SPENDINGS, CUT BACK ON NON-ESSENTIALS

- #9 REVIEW AND ADJUST

- #10 STAY DISCIPLINED

The plans of the diligent lead surely to abundance, but everyone who is hasty comes only to poverty.’

Proverbs 21:5 Tweet

Join our "Love money Scoops" group!

Join us in achieving financial stability! Receive a wealth of practical tips, budgeting hacks, investment insights, and strategies to achieve your financial goals!

IMPORTANCE AND BENEFITS OF BUDGETING

Knowing how to budget is an essential skill that empowers you to effectively manage your finances and avoid unnecessary debt. Whether you’re a young adult in college or not, you’re bound to face numerous expenses, such as groceries, transportation, tuition, housing, textbooks, and more. I was there, and still am! However, creating a well-structured and understandable budget will help you immensely! You will learn how to make informed financial decisions, prioritize the essentials, save and plan for the future, and develop responsible money habits.

You are more than capable of executing proper personal financial planning, and by doing so, you can achieve financial stability and be able to focus on maintaining a healthy work-life balance and/or aiming toward academic success.

So, start budgeting in college, budgeting as a young adult, right now! Begin building your own financial security (because no one is going to do it for you) by following this simple guide on managing your money!

CREATING A BUDGET

1. GATHER FINANCIAL INFORMATION: ASSESS INCOME AND EXPENSES

To start, give yourself a clear picture of your financial situation by collecting all of your financial information:

- Income Sources (Part-Time, Full-Time, Side Hustles, Financial Aid, Scholarships)

- Expenses (Groceries, Transportation, Tuition, Books, Rent, Utilities, Entertainment)

2. CALCULATE YOUR TOTAL INCOME

Add up all of your income sources to determine your total monthly or semester income after taxes. Be sure to consider any fluctuations or irregularities (hours worked, tips) in your income.

3. LIST AND CALCULATE FIXED EXPENSES

Identify your fixed (unchanging) expenses, such as tuition, rent, insurance, and car payments. These are expenses / bills that remain constant every billing cycle and are essential for your daily living and education.

Tip: Saving should be a fixed expense, a bill, NOT on an option in order to build financial stability and discipline.

4. LIST AND CALCULATE VARIABLE EXPENSES

These are expenses that vary from month to month or are considered non-essential. When calculating for these variable expenses, be realistic and estimate an average amount of how much you typically spend or want to allocate for that expense. Remember to be mindful of necessities and avoid overspending on non-essential items. These variable expenses can be: groceries, subscriptions, transportation, personal spendings, dining out money.

5. SUBTRACT EXPENSES FROM INCOME

Add your fixed and variable expenses, then subtract it from your total monthly/per semester net income (after taxes), to find your available spending money. If you have a positive number, that means you have money left over after covering all expenses. If it’s negative, you will need to make adjustments to your budget. Whether that be eliminating non-essentials, spending less, or earning more money.

11 SMART WAYS TO SAVE MONEY WITHOUT SACRIFICING FUN

6. ALLOCATE AVAILABLE FUNDS TO CATEGORIES

Organize your available spending money into separate categories based on what matters most to you. Set aside funds for fixed expenses, sinking funds (saving up for something in particular), long-term savings or investments, or extra spending money.

7. PRIORITIZE SAVINGS: EMERGENCY FUND

Prioritizing savings will help you manage your finances more effectively as a college student and young adult. Consider setting aside a portion of your income per paycheck after distributing to fixed expenses, and before spending on variable expenses.

Create two funds: one for emergencies when unexpected expenses come up, number two for long-term savings goals like paying off student loans or paying for a trip. Building an emergency fund with at least 3-6 month’s worth of living expenses is a goal you should reach. It will provide you financial security and peace of mind to handle future unforeseen events.

Look for ways to save money without compromising your college experience, such as using student discounts, buying used textbooks etc. To learn more ways on how you can save more and spend less, read our post on 11 Smart Ways to Save Money in College.

Keep in mind, small savings can accumulate over time and positively impact your budget and money management. You will be proud of yourself!

8. TRACK YOUR SPENDINGS AND CUT BACK ON NON-ESSENTIALS

Look for areas where you an cut back on non-essential spending: eating out, coffee, snacking, subscriptions and more. Consider cooking at home instead of dining out, student discounts for bundling subscriptions, or buying used textbooks.

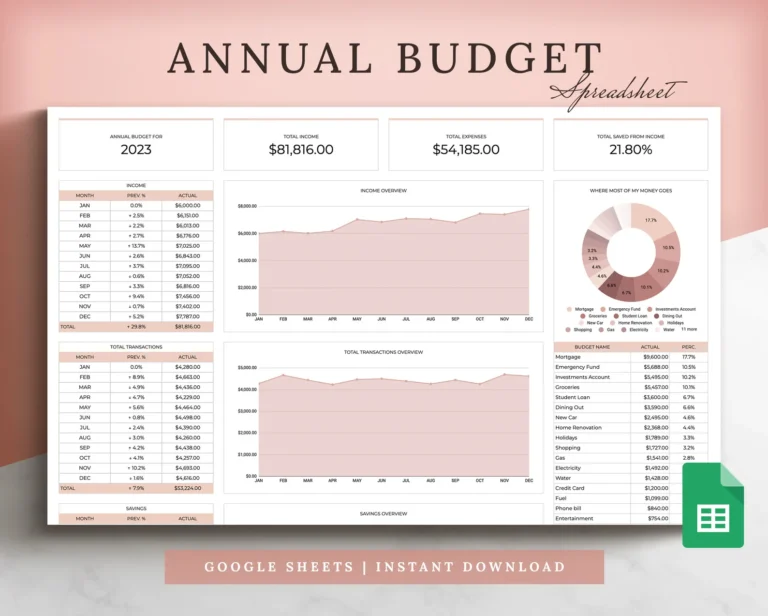

It is important to keep track of your expenses to minimize debt and to plan ahead. You can do so by using budgeting apps, planners, spreadsheets or online tools. Read our post on The Best Budgeting Planners: Must-Haves for Every College Student and Young Adult, to see which planner best fits you. It is not limited to just physical planners, but also spreadsheets that can automatically calculate everything for you.

Monitor your spending regularly and compare it to your budget. This practice will help you identify areas where you need to cut back and keep your finances on track.

Here are a couple of my favorites that I have purchased myself:

THE BEST BUDGET PLANNERS: MUST-HAVES FOR EVERY COLLEGE STUDENT & YOUND ADULT

9. REVIEW AND ADJUST

Regularly review your budget and compare it with your actual spending. Adjust your budget as needed to accommodate changes in income or expenses. This will help you stay on track and achieve your financial goals.

To give you an idea of how I budget, here is a small example of one of my own budget spreadsheets:

10. STAY DISCIPLINED

Stick to your budget and avoid impulse purchases! Do your best to minimize your debt and only spend money that you have. This means, even if you have a credit card, only use it in case of emergencies OR if you know you can pay it back within that billing cycle to avoid interest.

Be mindful of your financial priorities and remember that budgeting, personal finance, is a skill that you will need to develop for financial success in your young adult years and beyond!

Set yourself up for success, starting today!

I know it can seem quite daunting to realize how little money you have, how much you actually spend, and how expensive everything is. But it is necessary! By assessing your income and expenses, creating a realistic budget, tracking your spending, and making informed financial decisions, YOU CAN ACHIEVE FINANCIAL STABILITY!

With careful personal financial planning, wise spending habits, and commitment to your budget, you can make the most of your young adult years and college experience WHILE setting yourself up for a successful financial future.

Use and apply this guide to provide you the peace of mind that comes with financial empowerment.

love, Jas Joy

Other Posts You May Like

Related Topics

A Payday Routine: How to Budget Your Paycheck Like a Financial Expert