A Payday Routine: How to Budget Your Paycheck Like a Financial Expert

Once you get the hang of accurately budgeting your money, knowing how much you make and where it is all going, then you can move toward allocating your earnings automatically every time you get paid.

This is one of the most effective ways to set yourself free from living paycheck to paycheck or overspending right after payday.

Creating a payday routine is absolutely essential to not only establishing good money habits, but also helping you feel financially stable and in control. Wouldn’t you want to feel confident in your money management abilities? If so, I will help you do that!

I will give you practical budgeting tips for pre-payday, during payday and post-payday.

LET'S GET INTO IT! : A PAYDAY ROUTINE HOW TO BUDGET YOUR EARNINGS LIKE A FINANCIAL EXPERT

Please note that this site contains affiliate links to products or services from third-party websites. Furthermore, we are not financial advisors. The information provided is for general informational purposes only and should not be considered as professional financial advice. By reading this post, you acknowledge and agree to the full terms of our disclaimer.

Table of Contents

“But remember the LORD your God, for it is He who gives you the ability to produce wealth, and so confirms His covenant, which He swore to your ancestors, as it is today.”

Deuteronomy 8:18 Tweet

Join our Personal Finance group!

Join us in achieving financial stability! Receive a wealth of practical tips, budgeting hacks, investment insights, and strategies to achieve your financial goals!

Why a Payday Routine Matters

Even with so many resources available to us only 1/3 of the global population are financially literate. This could be due to countless reasons, but despite it all, you are here! Which means, you are on the right path to becoming a good steward over your finances.

Why does having a payday routine matter? Having a routine creates financial discipline and clarity. It will also help you with removing emotion from your money decision-making.

Financial psychology plays a big part in your spending habits, especially on payday. Your thoughts may go to “now that I have money, I can spend it”, completely forgetting that you have bills due in two weeks or financial goals to reach.

Building a routine with your money—like setting up automatic transfers or allocating your money as soon as you get paid—will make it much easier for you to stick to your goals and feel more in control of your finances.

Let me show you How to Budget Before and After Your Paycheck Arrives.

How to Budget Before Your Paycheck Arrives

Step 1: Know Your Net Pay (Actual Take Home Pay)

Know Your Net Pay (Actual Take Home Pay)

First, you need to know your net pay, which is also known as your actual take-home pay.

Review your most recent paystubs to see if your earnings are consistent or not. If they are consistent, perfect—an easier job for you. If they fluctuate, gather your most recent six paystubs, total your net earnings, and divide by six. This will give you your average net pay per paycheck. You can use this average to pre-assign every dollar, or you can do what I do—estimate my earnings based on my hours worked.

I refer to a previous paystub where I worked the same number of hours as the current pay period and use that net pay as a reference. If I worked slightly more or less, I apply the same tax percentage from that paystub to my current gross earnings to estimate my net pay.

For this post, I’ll be budgeting a July paycheck based on a net pay of $2,300, with zero dollars rolled over from the previous month.

Step 2: List All Upcoming Bills & Fixed Expenses

List All Upcoming Bills & Fixed Expenses

Next, list all your bills and fixed expenses alongside their due dates. This can include housing payments, subscriptions, utilities, and debt payments. Anything that is required to be paid for monthly.

If you’re paid twice a month, you can choose to split your bills and fixed expenses between the two paychecks—covering half or most with the first and the rest with the second. I do this myself so I have some money left over for savings and spending every paycheck.

Now, calculate the difference between your net pay and your bills and expenses.

For myself, I am allocating $1,200 to bills and fixed expenses. That leaves me with $1,100 remaining.

For the remaining amount, we are going to…

Step 3: Pre-Assign Every Dollar

Pre-Assign Every Dollar

Step 3, pre-assign every dollar toward savings and spending.

For this specific budgeting strategy, I like to use a 65/35 rule for the income left after my bills & fixed expenses—allocating 65% for spending and 35% for savings.

Spending includes any variable expenses such as groceries, dining out, hobbies, entertainment, etc. Savings include your emergency fund, vacation fund, investments, and more.

The percentages are up to you and your lifestyle. Consider your family size, spending habits, and savings goals when deciding how much to designate to each category.

With $1,100 left over, I will allocate $715 to my spending account and $385 to my savings account.

Step 4: Automate

Automate

Number 4: Automate! Automating the allocation of your income before it hits your account will prevent you from overspending, forgetting to save, or feeling overwhelmed when it’s time to pay bills.

My recommendation is to have at least three separate accounts: one for all your bills, another for your spending, and a third for your savings. You can have more based on your goals and lifestyle.

If your income is consistent, you can set up one-time or recurring transfers and payments for everything—bills, fixed expenses, variable expenses, and savings.

If your income varies, it’s a good idea to set up transfers and payments for just your bills and fixed expenses. Then, based on your budget percentages, transfer the remaining income once you get paid into your designated savings and spending accounts.

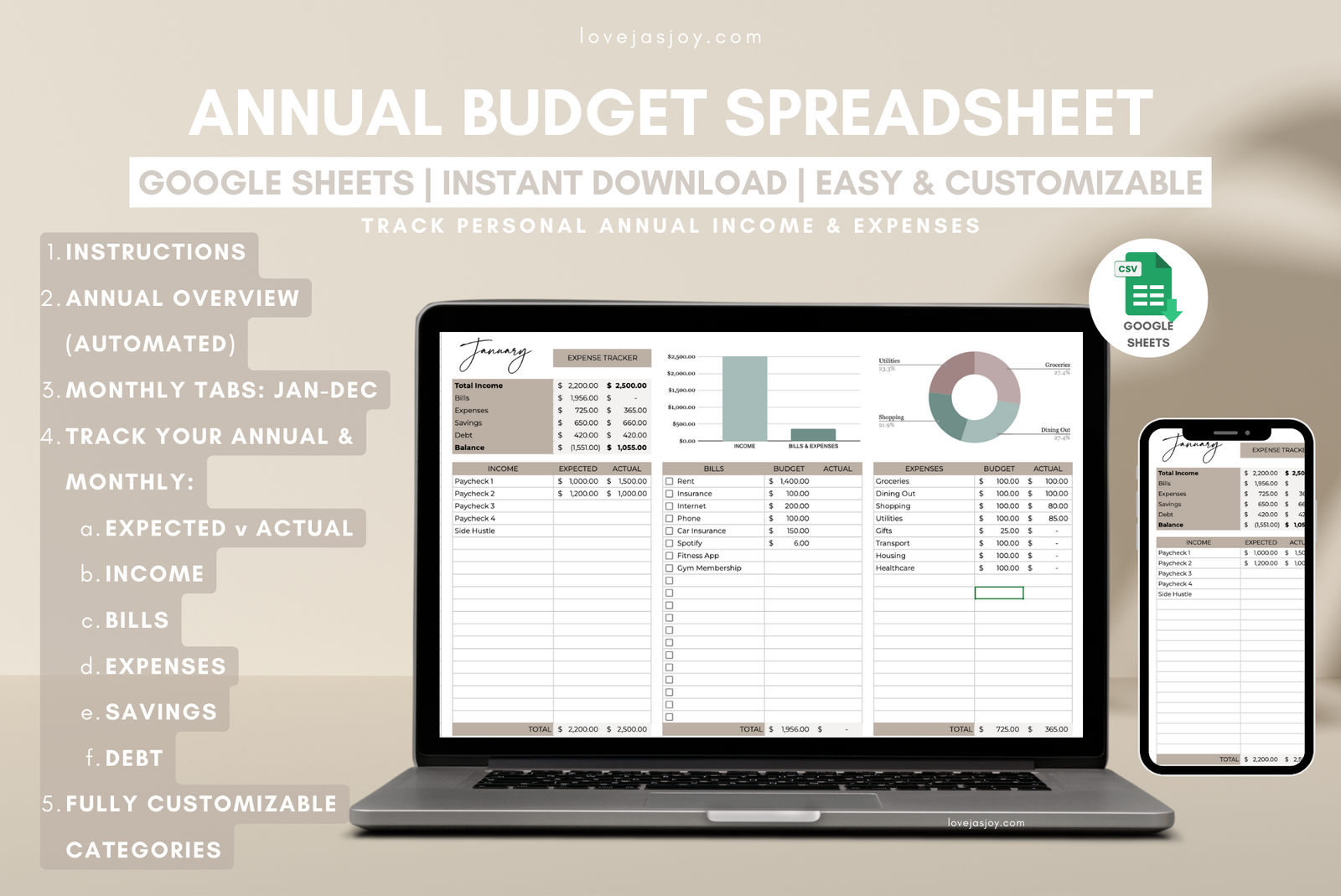

Annual Budget You can Stick to

An annual budget is perfect for understanding your finances all year round. Project your cash flow and figure out what money habits work for you!

What to Do When Your Check Hits

What to Do When Your Paycheck Hits: Pay or Schedule Your Bills Immediately

Pay or Schedule Your Bills Immediately

If you haven’t already done this in Step 4, set up a one-time or recurring transfer on your pay date into your bills and fixed expenses account. Then, schedule your automatic payments to be paid directly from that account.

One-time transfers work best if you prefer a more hands-on approach to managing your budget. Whereas, recurring transfers are ideal if you’d rather automate the process and not stress about manually allocating your money each time.

What to Do When Your Paycheck Hits: Pay Yourself First

Pay Yourself First

Before you start spending, pay yourself first! This means immediately transferring a percentage of your income into your savings, whether it’s for your emergency fund, sinking funds, or future goals.

Treat your future self like a priority—not an afterthought. Automate it if you can, so it happens without effort. Even a small amount adds up over time!

What to Do When Your Paycheck Hits: Allocate Spending Categories

Allocate Spending Categories

Referring back to Step 3—pre-assigning every dollar—you don’t have to break down your spending, but you can choose to allocate specific amounts within your spending percentage.

For example, you might set aside exact amounts for groceries, dining out, gas, or entertainment. This helps prevent overspending in any one category and keeps you focused on your priorities.

Referring to my $715 spending category, I want to designate $350 toward groceries, $200 toward dining out, $100 toward gas, and the remaining on entertainment.

It may change as you spend, but you can always…

What to Do When Your Paycheck Hits: Review, Adjust, and Reflect

Review, Adjust, and Reflect

When your check hits, it’s important to review, adjust, and reflect regularly—whether that’s at the end of the day or during weekly check-ins.

Doing so will help you stay aware of how your spending aligns with your budget and give you the chance to make real-time adjustments as needed.

Be flexible and give yourself grace. Yes, stay on track toward your financial goals, but also don’t excessively restrict or overwhelm yourself. Keep your budget dynamic and adaptable so that it works for your changing needs.

Common Mistakes to Avoid

- Impulse spending after payday.

- Forgetting irregular expenses.

- Not updating your budget monthly or quarterly.

- Excluding your cash buffer that is possibly needed for next month’s expenses.

Tools to Make Your Payday Routine Easier

- Banking features like auto-transfers and early direct deposit.

- Budgeting apps (YNAB, Mint, EveryDollar, etc.)

- Budget planners, spreadsheets, printable templates. My faves:

that is it!

Remember that consistency is key! Consistency creates good financial habits and you will grow to be disciplined with your money. It may not be easy at first, but the more you execute a routine, the easier it will get. And if it doesn’t get easier, make adjustments little by little until you build a routine that best fits you.

You got this! If you need any help, don’t be afraid to reach out to us at services@lovejasjoy.com. We are here to help you with your money management needs.

Find this article in video form on our YouTube Channel @lovejasjoy 🙂

Love,

Jas Joy

Other Posts You May Like

Related Topics

A Payday Routine: How to Budget Your Paycheck Like a Financial Expert