9 Everyday Signs You’re Doing Well Financially

It can be difficult to know for yourself because you’re caught up in your emotions about money. You might not feel “rich,” but guess what? That doesn’t mean you’re doing poorly with money!

In fact, if you’ve been putting in the effort to make small, consistent improvements with your finances, you’re probably doing better than you think. And better than 2/3 of the global population!

It is sad to say but we live in a very materialistic centered time. Success is often measured by luxury—designer bags, five-figure vacations, new cars, and owning a home by 30. But for many of us (me included), that’s just not real life!

Real life is budgeting. Real life is getting back on track after falling behind. Real life is celebrating the small wins and making intentional money moves with what we have.

And sometimes, it’s easy to miss the signs that you’re actually making real, valuable progress.

So let’s pause for a moment and take some time to really reflect on our financial standing.

here are: 9 low-key but powerful signs that you’re doing well financially

Please note that this site contains affiliate links to products or services from third-party websites. Furthermore, we are not financial advisors. The information provided is for general informational purposes only and should not be considered as professional financial advice. By reading this post, you acknowledge and agree to the full terms of our disclaimer.

Table of Contents

- Be Proud in Doing The Work

- You pay your bills on time every month

- You’ve built a small emergency fund

- You know where your money goes each month

- You’re able to cover basic needs without borrowing

- You have a system for paying off debt

- You’re saving for something specific

- You make thoughtful spending decisions

- You’ve stopped living paycheck to paycheck

- You’ve invested in your retirement

“But remember the LORD your God, for it is He who gives you the ability to produce wealth, and so confirms His covenant, which He swore to your ancestors, as it is today.”

Deuteronomy 8:18 Tweet

Join our Personal Finance group!

Join us in achieving financial stability! Receive a wealth of practical tips, budgeting hacks, investment insights, and strategies to achieve your financial goals!

Be Proud in Doing The Work

If you recognize even just a few of these in your own life, take a moment to feel proud. You’re showing up, you’re doing the work, and you’re building the habits that lead to long-term financial freedom.

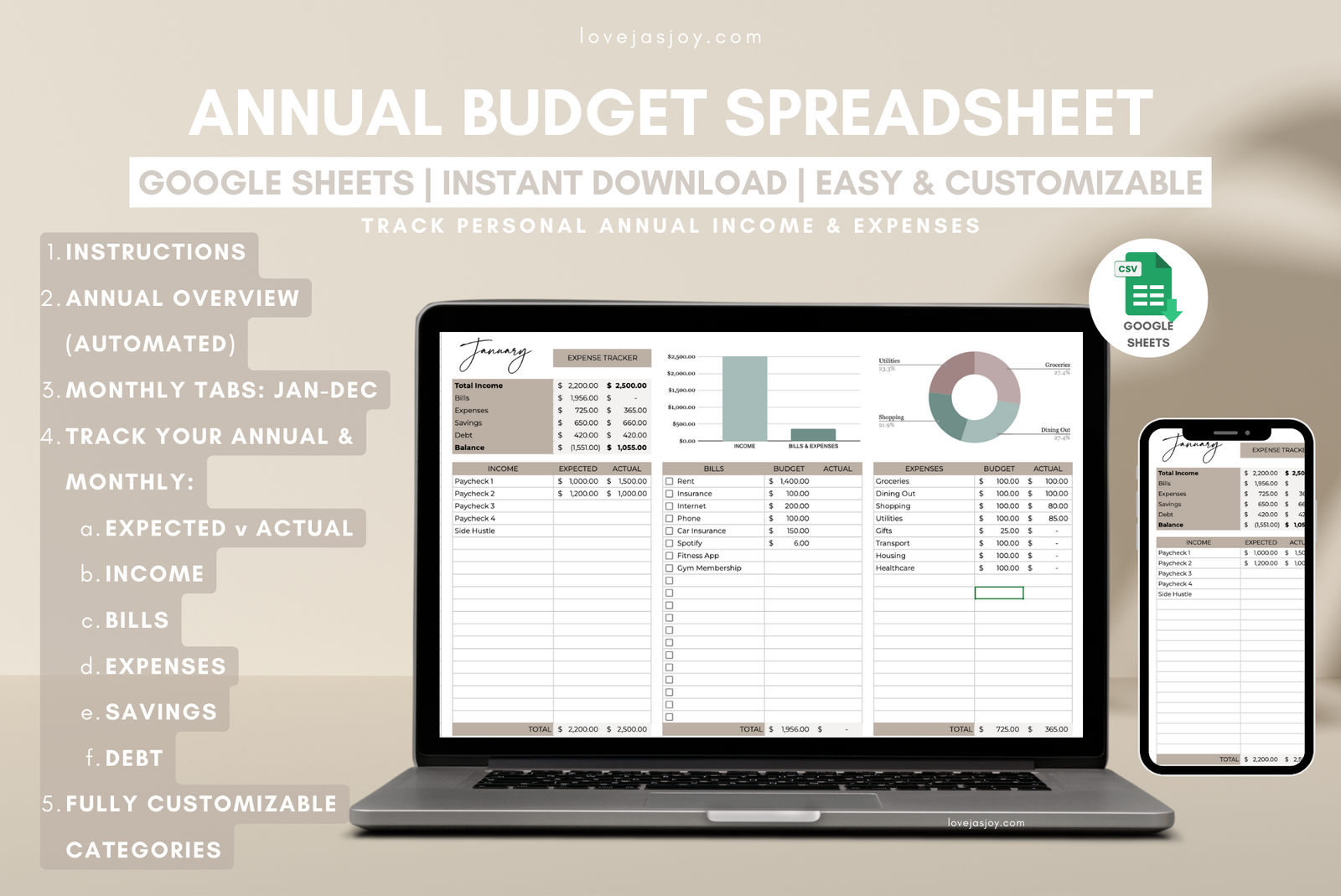

If you’re just starting out and want to stay on track with your finances, check out my shop lovejasjoy.store where you can get affordable budgeting spreadsheets (that I personally use!). PLUS subscribe to my YouTube Channel and stay up to date with this website for more simple personal finance tips & strategies!

You Pay Your Bills on Time Every Month

Everyday Sign You're Doing Well Financially #1

Even if money is tight and the due dates are close, you’re keeping up. That’s no small thing! Paying your bills on time helps you avoid late fees, protect your credit score, and stay in control of your financial obligations. Consistency builds trust with your money.

If this is NOT you, here is a banking recommendation: Consult with your bank if they offer overdraft protection. Often, banks provide checking line of credit or other optional overdraft protection services.

You’ve Built a Small Emergency Fund

Everyday Sign You're Doing Well Financially #2

It can be $500-$2000. It might not feel like much, but that little cushion is huge for peace of mind. A mini emergency fund is your first line of defense against life’s surprises like car repairs, medical co-pays, or unexpected bills.

The fact that you’ve set aside even a little bit shows discipline and care for your future self!

If this is NOT you, a suggestion: If you don’t already have one, create a budget. It is important to know where your money is going and how much you can realistically set aside toward your emergency fund.

Read these articles to help you start:

- Create a budget you can stick to throughout the year

- Learn how to follow a budget rule and tailor it to your lifestyle: 60/30/10 Budget

- Guide to start your finances from scratch, or reset it: Mid Year Financial Reset

You Know Where Your Money Goes Each Month

Everyday Sign You're Doing Well Financially #3

You’re Able to Cover Basic Needs Without Borrowing

Everyday Sign You're Doing Well Financially #4

If you can afford groceries, gas, rent, and utilities without turning to a credit card or personal loan, you’re already ahead! Nearly half of americans depend of a credit card to cover essential living expenses. Incredibly heartbreaking, but that is reality.

So, if you are meeting your basic needs with your own income, that is a major accomplishment! It shows your financial foundation strong and is capable of growing stronger.

If this is NOT you, an important personal finance tip: Create a strict budget for yourself. Also, get a personal finance coach if you need to!

I know it doesn’t sound fun, but it is an absolute must if you want to set yourself free from this huge financial burden and start making progress.

manage your money like a pro

The 60/30/10 Budget Method! Is it the new 50/30/20? Is it best for your lifestyle and financial goals? Find all that you need to know in this article.

You Have a System for Paying Off Debt

Everyday Sign You're Doing Well Financially #5

Whether you’re using the snowball method, avalanche method, or any method that has been working for you—you have a strategy. This is a huge win! Millions of people don’t know when they will have their debt paid off, let alone have a solid plan in place. So, if you have a plan for your debt it means you’ve decided to face it, manage it, and work toward becoming debt-free with intention!

If this is NOT you, here is a finance tip: Read up on some free personal finance resources of how to pay off your debt AND also get yourself a debt payoff budgetsheet or template.

I will be posting a debt payoff calculator to my shop soon, but until then, here are some other great ones:

You’re Saving for Something Specific

Everyday Sign You're Doing Well Financially #6

It doesn’t have to be an expensive, high-end vacation. Maybe you’re putting money away for the holidays, a hobby, a birthday present or a weekend trip. That is intentional saving! And intentional saving leads to intentional living. You’re making room for joy and responsibility.

To aid your money saving journey, I put together a must-have Sinking Funds Budgetsheet:

Here are some other recommendations too from Etsy! (can you tell I’m obsessed with Etsy budgetsheets?)

You Make Thoughtful Spending Decisions

Everyday Sign You're Doing Well Financially #7

You think twice before impulse buying. You may even wait the recommended 24 hours to 7 day period before considering the item again. You diligently compare prices. You skip the sale if it doesn’t fit your priorities.

This all means you’re not just spending to spend, you’re making your money work for you! Yes, this is one simple method to make your money work for you. Intentional, thoughtful spending is financial maturity in action and a step toward financial stability.

If you DON’T do this, here is a finance tip: Wait 24-48 hrs before considering the item again. This waiting period should be enough time for you to think the purchase through and rationally decide if it is worth the money or not. Also, consider the opportunity cost of purchasing or not purchasing the item.

You’ve Stopped Living Paycheck to Paycheck

Everyday Sign You're Doing Well Financially #8

Even if you only have a $100 buffer between pay periods, that’s progress! Creating breathing room between paychecks is a key milestone on the way to financial stability. It reduces stress, increases flexibility, and gives you more control over your money.

If you have not reached this point yet in your financial journey, a tip for you: Easier said than done, but increase your income. If you know you are worth more than what you’re getting paid now, ask your manager for a raise! Create a list of projects or assignments you successfully completed or went above & beyond in.

Another option would be to decrease your expenses. Talk to your lenders about decreasing your APR or refinancing for a lower monthly payment.

You’ve Started Investing for Retirement

Everyday Sign You're Doing Well Financially #9

You do NOT need a six-figure portfolio to be on the right track! In fact, the majority of citizens don’t even have a 6 figure portfolio until they’re closer to retirement. If you’ve opened a Roth IRA, 401(k), or have started contributing to a work retirement plan–that counts as investing for retirement.

The amount matters less than the habit. You’ve taken the most important step which is simply getting started.

If you have not taken action yet, a finance tip for you: Talk to your employer about retirement plans they may offer and how to enroll (if you have not already). Ask if they offer employer match, and if so, max it out if you can.

Open a ROTH IRA with your bank/credit union or through a personal favorite, Robinhood. ←PS Claim a free stock using my link :).

this concludes 9 everyday signs you're actually doing well with your money!

No matter where you are on your financial journey, remember: You don’t have to be perfect. You just have to be intentional.

If you’re checking off any of these signs, you’re doing wonderfully! You are building a solid foundation for your financial future. Every step you take, small or big, is progress that will pay off over time, both financially and emotionally.

Keep going. Keep budgeting. Keep saving. Keep learning.

And if you ever feel stuck or unsure of your next step, don’t hesitate to reach out to us at services@lovejasjoy.com or explore more free personal finance guidance here at lovejasjoy.com and our YouTube Channel.

You’ve got this, you’re not alone! I’m cheering you on every step of the way. 💛

Love,

Jas Joy

Other Posts You May Like

Related Topics

A Payday Routine: How to Budget Your Paycheck Like a Financial Expert