29 Achievable Finance Goals for Your 20s

Let’s go over 29 Finance Goals You Can Achieve in Your 20’s!

You may have some goals in mind, or you may not, wherever you are on the scale, we got you covered! These 29 finance goals for your 20s are not only realistic, but achievable.

It is not too late to start establishing goals and pursuing them. Have confidence and keep persevering to achieve them!

LET'S GET TO IT, HERE ARE YOUR 29 ACHIEVABLE FINANCE GOALS FOR YOUR 20'S!

Please note that this blog post may contain affiliate links to products or services from third-party websites. The information provided in this blog post is based our own personal experiences, research, and opinions. By reading this blog post, you acknowledge and agree to the terms of this disclaimer. Read our full disclaimer page. If you have any concerns or questions, please feel free to contact us.

Table of Contents

- BUILD AN EMERGENCY FUND

- CREATE A BUDGET

- PAY OFF DEBT

- ESTABLISH GOOD CREDIT

- START INVESTING

- BEGIN SAVING FOR RETIREMENT

- SET FINANCIAL MILESTONES

- LIVE BELOW YOUR MEANS

- LEARN ABOUT TAXES

- BUILD MULTIPLE INCOME STREAMS

- NEGOTIATE SALARY INCREASES

- INVEST IN EDUCATION

- INSURANCE COVERAGE

- PLAN FOR LARGE PURCHASES

- REVIEW SUBSCRIPTIONS

- CONTRIBUTE TO A HEALTH SAVINGS ACCOUNT

- NETWORK & BUILD RELATIONSHIPS

- AUTOMATE SAVINGS

- TRACK NET WORTH

- LEARN ABOUT INVESTING

- SEEK FINANCIAL GUIDANCE

- DEVELOP A SIDE BUSINESS

- START AN EMERGENCY BUSINESS FUND

- CREATE A 30 DAY FINANCIAL CHALLENGE

- REDUCE NON-ESSENTIAL EXPENSES

- BUY REAL ESTATE

- INCREASE CHARITABLE GIVING

- CREATE A WILL & ESTATE PLAN

- BE GRACIOUS WITH YOURSELF

For which of you, desiring to build a tower, does not first sit down and count the cost, whether he has enough to complete it? Otherwise, when he has laid a foundation and is not able to finish, all who see it begin to mock him, saying, ‘This man began to build and was not able to finish.’

Luke 14:28-30 Tweet

Join our Personal Finance group!

Join us in achieving financial stability! Receive a wealth of practical tips, budgeting hacks, investment insights, and strategies to achieve your financial goals!

29 Achievable Finance Goals for Your 20s

#1 Finance Goal for Your 20s

Build an Emergency Fund

Establishing an emergency fund is one of the first finance goals you need to have in your 20s!

The first goal to achieve, that is much more attainable, is saving $1500. After that, continue building your emergency funds to have at least 3-6 months’ worth of living expenses in case of unexpected financial setbacks.

We have spilled some tried and true methods of how you can Save Money in College and as a Young Adult WITHOUT Sacrificing Fun! Use these methods to help you build your funds faster and to develop the discipline of being in control of your finances.

#2 Finance Goal for Your 20s

Create a Budget

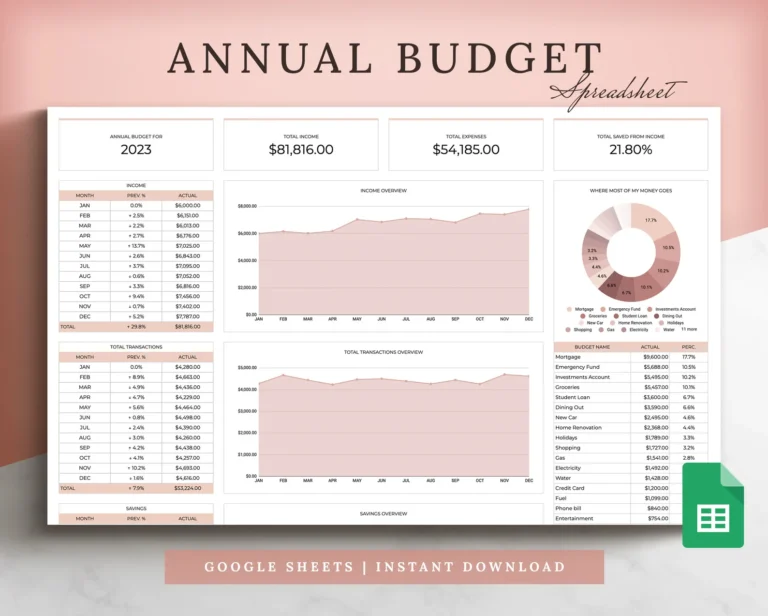

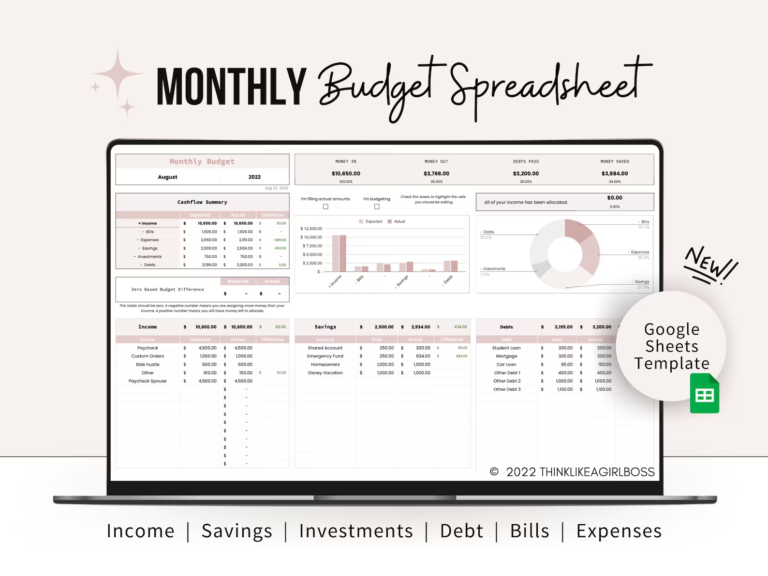

Develop a monthly budget to track your income and all of your expenses (e.g, student loans, books, groceries, transportation). Having a budget, whether that be per paycheck or a monthly budget, will help you immensely in managing your finances more effectively. You will be able to see how much you are spending, what you are spending on, what you need to cut back on or how much more you need to work to catch up with bills.

We have written a simple guide on How to Create a Budget.

You can build your own budget sheet on Google Docs. This tutorial will walk you through how you can build a budget from scratch: ThinkLikeAGirlBoss Budget Spreadsheet Tutorial.

There are also hundreds of Affordable Budget Spreadsheets on Etsy that are under $10, customizable and compatible with google docs or excel.

These are a few of the budget spreadsheets that I personally love.

#3 Finance Goal for Your 20s

Pay Off Debt

Prioritize paying down credit card debt, high-interest loans, or any other debt you may have to save money on interest! There are two methods you can use to pay off your debt, the Snowball Method and the Avalanche Method.

The snowball method focuses on paying off the smallest debt first (regardless of interest rate), while making minimum payments to the rest of your debts. After the smallest debt is paid, you use that money to continue paying off the next smallest debt + its minimum payment.

The avalanche method focuses on paying off debt with the highest interest rate first, and going down the list (high interest rate to lowest interest rate) until all of the debt is paid off. You pay as much as you can on the highest interest debt while continuing to make the minimum payment on the other debts. Once the highest is paid off, you use that money to continue down the list.

#4 Finance Goal for Your 20s

Establish Good Credit

Build a positive credit history by always making on-time payments and managing your credit responsibly! Keeping your debt to credit ratio will help your credit score.

With that said, if you have a credit card, use it only for emergencies or if you know you can pay it off before the end of the statement period. You do not want to accumulate bad debt!

If you can’t pay it off before the statement period or within the term you set, don’t buy it! Your credit score will take a huge hit that will be hard to recover from, if you can’t make payments on time or show you are irresponsible in paying off your debt.

#5 Finance Goals for Your 20s

Start Investing

#6 Finance Goals for Your 20s

SAVE FOR RETIREMENT

Begin saving for retirement early to take advantage of compounding interest and to ensure a comfortable future. It is better to start now than later. The later you start, the more you will need to set aside to ensure you live comfortably during retirement.

#7 Finance Goals for Your 20s

Set Financial Milestones

Identify specific financial goals like buying a car or home, and create a plan to achieve them. An example would be the goal to save $75k for a home down payment by January 2028. The plan would be to save at least $1471 per month to reach $75k by January 2028 (51 months away).

#8 Finance Goals for Your 20s

Live Below Your Means

Avoid lifestyle inflation and spend less than you earn to save and invest more! This is where creating a budget is important. Calculating your income and expenses is important in ensuring you spend less than you earn, to and contribute more to your savings.

#9 Finance Goals for Your 20s

Learn About Taxes

Taxes are stressful, especially if you have obligations. With that said, understanding the basics and learning how to optimize your tax returns will empower you to minimize your liabilities and make informed financial decisions. It will also decrease financial stress by helping you plan and budget more effectively for any tax obligations you may have. Learning early is important in securing your financial well-being!

#10 Finance Goal for Your 20s

Build Multiple Income Streams

Explore side hustles, freelancing, or investments to diversify your income sources. Having your eggs in multiple baskets will help you achieve financial freedom and security. We have provided Practical and Achievable Ways You Can Make Money!

#11 Finance Goal for Your 20s

Negotiate Salary Increases

No matter what job you are working or career you are in, advocate for higher salaries as you gain experience and meet the criteria set by your employer. Know your value and worth, don’t settle for less because there are certainly companies out there that could offer more.

#12 Finance Goal for Your 20s

Invest in Education

Consider pursuing additional certifications or degrees to enhance your earning potential. Coursera, Skillshare, Udemy, LinkedIn Learning and similar platforms are great for building your skills and knowledge for yourself or for advancing in your career.

Smart Ways to Save Money!

These tips are NOT ONLY FOR COLLEGE STUDENTS! This can apply to anyone and everyone who is struggling to save. These tips will help you build your emergency funds and to gain more control of your finances and circumstance.

#13 Finance Goal for Your 20s

Insurance Coverage

Evaluate your insurance needs and ensure you have adequate coverage for your health, auto, and renters or homeowners insurance. Having all of these in place, optimizing your coverage, will ensure you are receiving the most benefits. It will help you save money in the long run if anything were to happen.

#14 Finance Goals for Your 20s

Plan for Large Purchases

Save for significant expenses like a new tv, a birthday party or wedding. If it is not an emergency, do not put yourself into unnecessary debt for it. Save ahead of time!

#15 Finance Goals for Your 20s

Review Subscriptions

Assess your subscriptions and eliminate unnecessary or unused ones to save more money. If you are not using the subscription on a near daily or on a weekly basis, it is not worth the money.

#16 Finance Goals for Your 20s

Contribute to a Health Savings Account (HSA)

If eligible, contribute to an HSA to save for medical expenses tax-free! Medical bills are not cheap, even deductibles can add up. With that said, save yourself the financial stress by setting aside money that can accrue dividends AND is tax free, to pay for your medical expenses.

#17 Finance Goal for Your 20s

Network and Build Relationships

Networking? Yes, networking can help you financially! Building relationships can open doors to more career opportunities and financial growth.

The people you are around can hold you accountable in pursuing your goals by being an example themselves or by providing wisdom and opportunities.

#18 Finance Goal for Your 20s

Automate Savings

Setting up automatic transfers to your savings or investment accounts will ensure consistent contributions. It will also support your financial goals of spending less, saving for a large purchase, building your emergency fund and more.

#19 Finance Goal for Your 20s

Track Net Worth

It is good to regularly calculate your net worth to gauge your financial progress. It is important to know the difference in what is supporting your goals and what isn’t.

If you find your net worth declining or fluctuating, re-evaluate your circumstances and create an action plan to stay on track toward financial success.

#20 Finance Goal for Your 20s

Learn About Investing

Educate yourself about different investment options and strategies. The internet is full of “How To”, “What Is”, “Step-by-Step.” Take advantage of all that is available to you.

YouTube is an amazing platform that can educate you on investing in the stock market, forex, cryptocurrency, dropshipping and so much more.

Here are some amazing young entrepreneurs that are incredibly successful and continue to achieve their financial goals through investing and more. Check them out on YouTube!

#21 Finance Goal for Your 20s

Seek Financial Advice

Consider consulting a financial advisor for personalized guidance on your financial journey. You can contact a financial advisor at your bank or by researching online.

Financial advisors are experts in helping you achieve your financial goals by creating a budget plan with you, providing the right investment options, ensuring you are receiving the most benefits from your insurances and more.

#22 Finance Goals for Your 20s

Develop a Side Business

Start a side business or freelance work in your spare time to generate additional income streams and gain valuable entrepreneurial experience.

Starting a side business can cost as little as $0. The ROI can be substantial, but you do have to be patient and create a business plan. Offering your service can cost you $0, but the opportunity cost is your time.

Blogging and Vlogging require as little as $100, but it does take a great amount of time to start seeing even a cent in your bank account.

Conduct your own research of how you can grow a side business that best suits you.

Take a look at How You Can Make Money as a Young Adult to read more about side businesses you can grow!

How to Make Money in College and as a Young Adult!

These are realistic and attainable! These are tried and true methods that can provide a sustainable amount of income, or just be a side hustle.

#23 Finance Goals for Your 20s

Start an Emergency Business Fund

If you do plan to start a business, save money to fund your entrepreneurial endeavors. If you are serious about your business, consider applying for an EIN.

You can use your EIN for opening a bank account under your business name, applying for loans and more. It is important to do your due diligence and research how to start a business in your state. Contact an accountant if necessary. You do not want to make the wrong decisions or walk into it blindly.

#24 Finance Goals for Your 20s

Create a 30 Day Financial Challenge

Creating a financial challenge for yourself can help you achieve your goals faster and keep you on the right track. Each day can be a challenge that will support one big financial goal, or it can be different challenges to help you develop financial discipline. Either way, decide on what will benefit you the most. Check out some examples of 30 Day Financial Challenges on Pinterest.

#25 Finance Goal for Your 20s

Reduce Non-Essential Expenses

Identify areas in your budget where you can cut back on discretionary spending to save more. It can be dining out, expensive hobbies, shopping, impulsive purchases or coffee. Tracking your expenses is important for this point! You can calculate which category is eating up the most of your money and decide if it is something you can cut back on or not.

#26 Finance Goal for Your 20s

Buy Real Estate

This goal may not be the most achievable for some in their 20s. Although, it is a top finance goal that you will want to achieve some point in your life.

Investing in real estate offers great benefits. It can provide a potential appreciation in property value over time (depending on various factors), hedge against inflation, and generate rental income. If done correctly, real estate can create a steady stream of cash flow and provide you tax advantages such as mortgage interest and property taxes.

Conduct your own research, educate yourself, create an action plan, execute and you can receive long-term financial security and accumulate wealth from real estate.

#27 Finance Goal for Your 20s

Increase Charitable Giving

Dedicate a portion of your income to charitable donations and support causes you’re passionate about. Support others on GoFundMe or research foundations online.

There are millions in need and sparing some disposable income will make all the difference in those peoples lives.

#28 Finance Goals for Your 20s

Create a Will and Estate Plan

Consult with an attorney to establish a will and estate plan to protect your assets and ensure your wishes are carried out. It is essential to check this off the list.

Protect what you have and make sure your hard work will go to where you want it to be.

#29 Finance Goals for Your 20s

Be Gracious with Yourself

Surely there are times we are not where we want to be. During these times, it is incredibly important to keep persevering and encouraging yourself.

Give yourself grace and be patient. The Lord says you will reap a harvest at the proper time if you do not give up (Gal 6:9). So, don’t grow weary in doing good and do not give up. Do the best you can for your future. The future you will thank you for it.

These money goals for your 20s can and will set you on a path toward financial security and success. Remember that financial planning is a journey, so start small and adjust your goals as your circumstances change. Be gracious and patient with yourself. Keep doing what you know you can and overcome your own limitations.

Do not give up and do not hold back because life does not stop for anyone. In more than just your financial journey, always choose to walk purposefully and wisely!

love, Jas Joy

Other Posts You May Like

Related Topics

A Payday Routine: How to Budget Your Paycheck Like a Financial Expert