How To Create An Annual Budget That You Can Actually Stick To!

Did you know that NOT knowing how to create an annual budget and NOT knowing how to effectively manage your money can cost you THOUSANDS OF DOLLARS? Literally!

According to Medium.com, 60% of Americans can’t pass a basic financial literacy test and 88% of graduating high schoolers state they are unprepared to handle money.

Let’s be real, the topic of money is stressful! It’s an incredibly emotional topic because we are either financially illiterate (meaning we have no idea how to manage our money), we genuinely don’t make enough to pay for all our bills, or we are too prideful or fearful to own up to our financial standing.

WITH THAT SAID, LET'S WALK THROUGH HOW TO CREATE AN ANNUAL BUDGET!

Please note that this site contains affiliate links to products or services from third-party websites. Furthermore, we are not financial advisors. The information provided is for general informational purposes only and should not be considered as professional financial advice. By reading this post, you acknowledge and agree to the full terms of our disclaimer.

Table of Contents

- MY #1 RULE TO MONEY

- WHAT IS AN ANNUAL BUDGET

- HOW TO BUILD AN ANNUAL BUDGET STEP BY STEP

- $1.99 Annual Budget Spreadsheet

- Step 1: List Everything!

- Step 2: Calculate Monthly Income

- Step 3: Estimate Monthly Costs

- Step 4: Define Your Financial Goals

- Step 5: Review & Adjust

- Important Follow Up Questions

- Step 6: Evaluate Your Progress

- CONTACT US FOR FINANCIAL COACHING

“But remember the LORD your God, for it is he who gives you the ability to produce wealth, and so confirms his covenant, which he swore to your ancestors, as it is today.”

Deuteronomy 8:18 Tweet

Join our Personal Finance group!

Join us in achieving financial stability! Receive a wealth of practical tips, budgeting hacks, investment insights, and strategies to achieve your financial goals!

MY #1 RULE TO MONEY

My #1 rule to money: There is NO shame in how much or how little you make.

Shame is found in HOW you manage your finances. Whether you are a low income earner or you are a multi-millionaire, the way you handle your money speaks volumes in your psychology towards money.

It’s NOT about the $$ dollar amount, but about the financial habits, decisions and priorities you personally set for yourself. If you manage your earnings with purpose, every cent can benefit your goals, REGARDLESS of your income level.

With that said, creating good financial habits STARTS by understanding your own cash flow and money behavioral patterns. How much you make, how much you spend, what your bills are, what exactly you spend your money on, and more. The answer to how you can find all of that out, CREATE AN ANNUAL BUDGET!

WHAT IS AN ANNUAL BUDGET?

An annual budget outlines your Jan-Dec income, expenses, savings, investments, and financial goals for the year. It will help you gain a deeper understanding of your income and expenses, help you achieve your financial goals, plan for major expenses (like Christmas), track financial progress, and build self-confidence in handling your finances.

HOW TO BUILD AN ANNUAL BUDGET STEP BY STEP

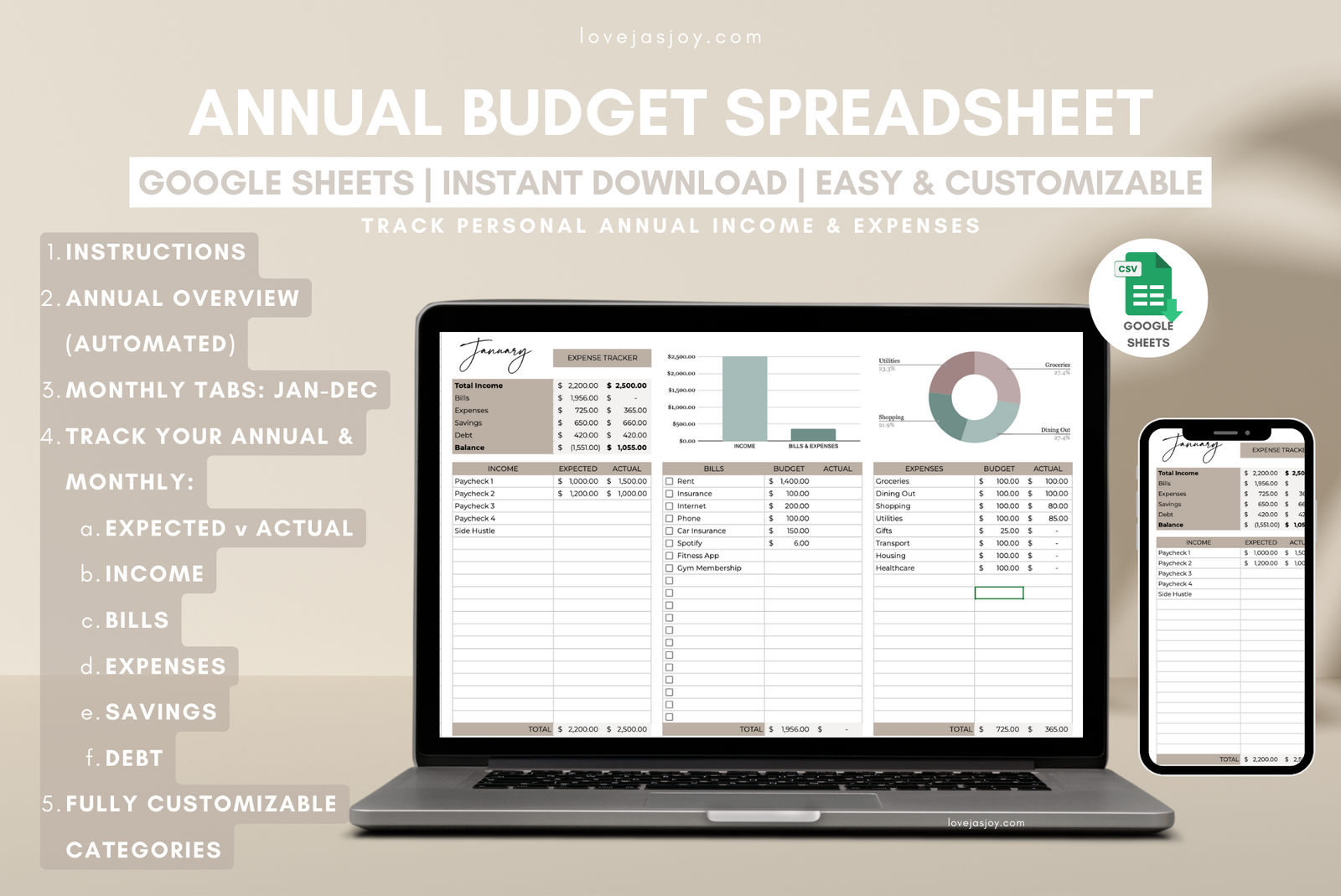

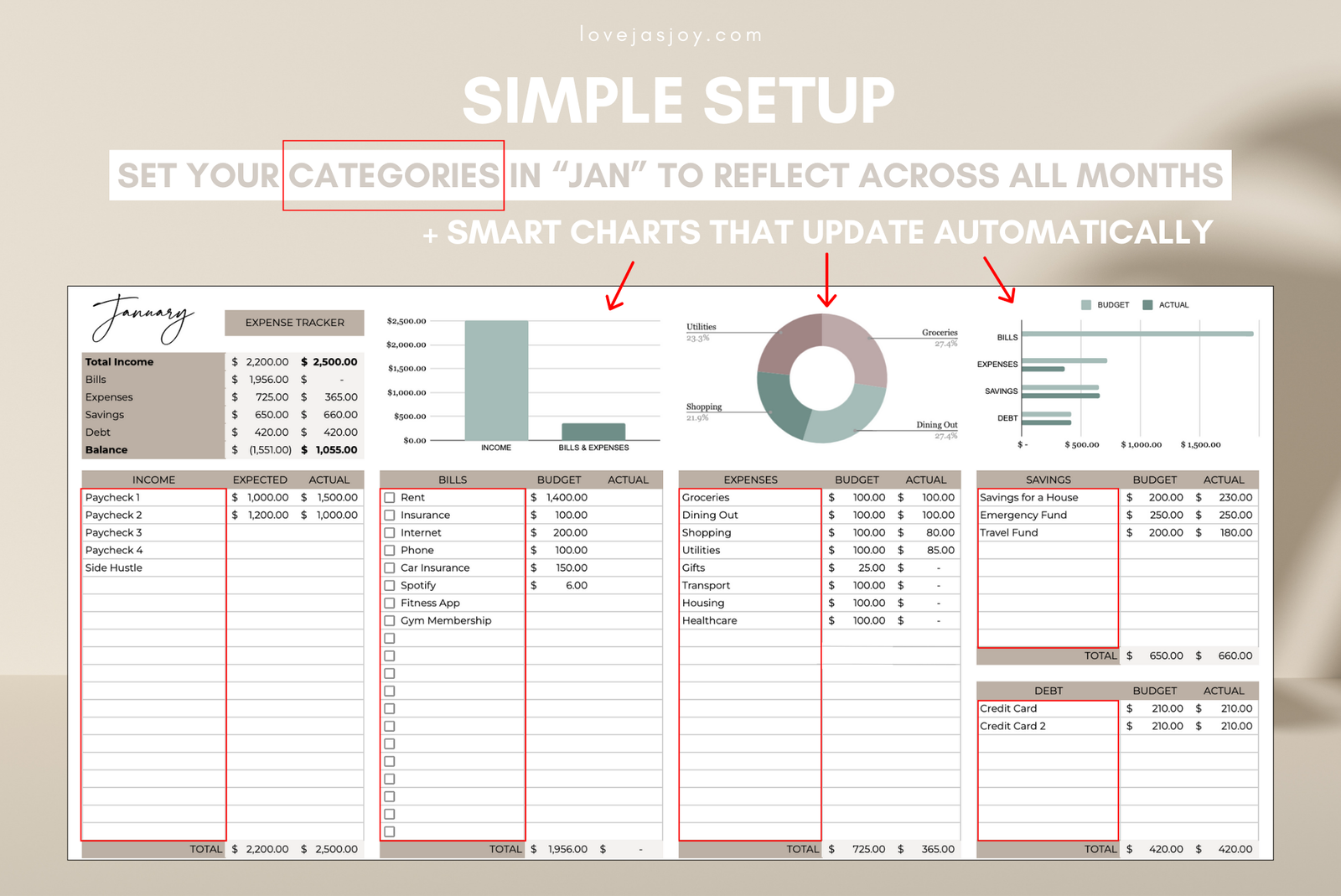

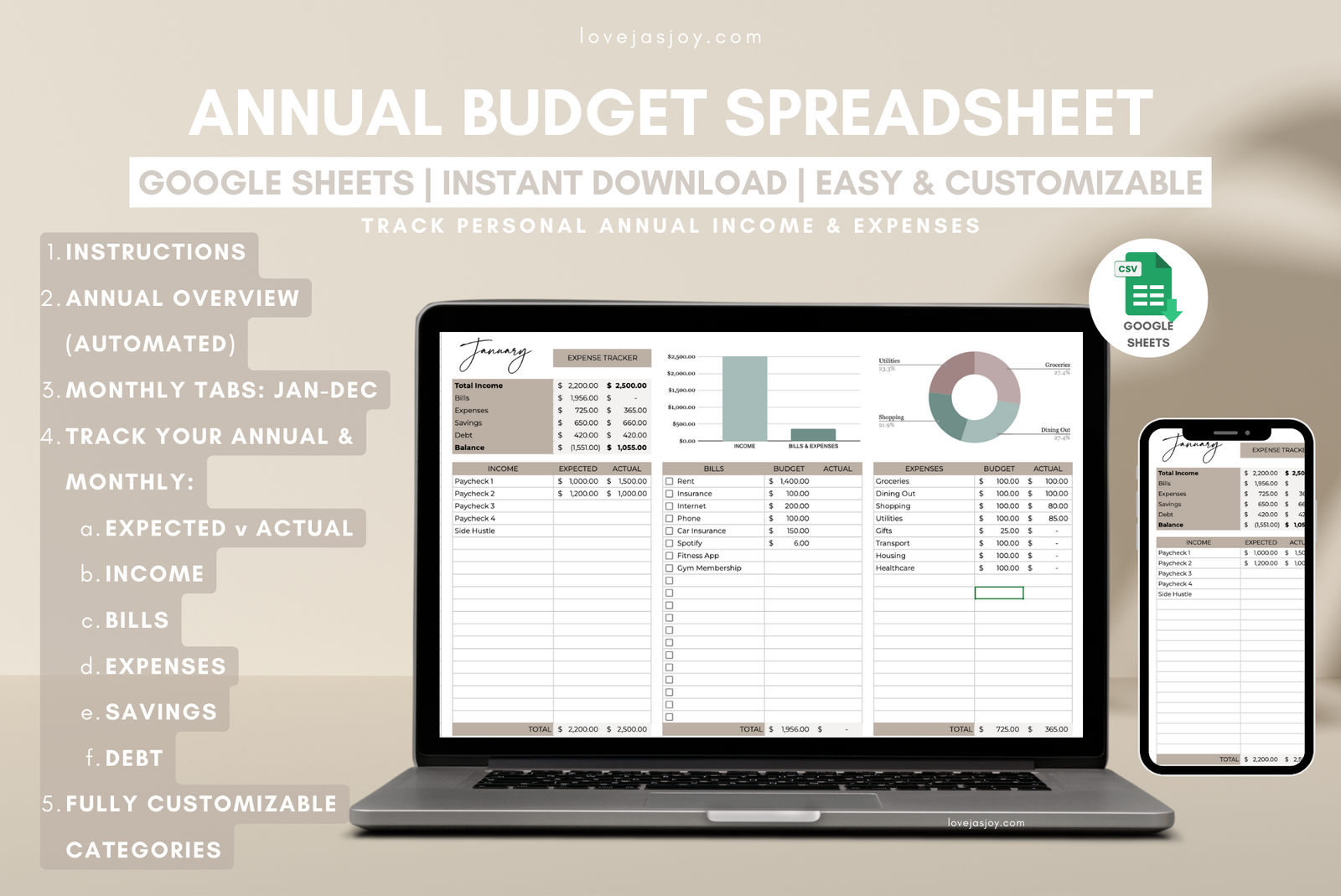

Simple Annual Budget Spreadsheet

To make your life easier, I made a Simple Annual Budget Spreadsheet. It is very straightforward and will help you get on track with your finances. I personally use it and modified it in my own way that fits my finances.

Get it for $1.99 when you USE CODE: 199LOVEBUDGET

STEP 1: LIST EVERYTHING!

List your sources of income, your fixed expenses (e.g. car payment, rent/mortgage, insurance), variable expenses (e.g. groceries, personal spendings), debt payments (e.g. credit cards, school loans), and savings (e.g. emergency fund). If you invest, you can include your contributions under the savings category as well.

STEP 2: CALCULATE MONTHLY INCOME

Calculate your annual income after taxes (net income) and divide it by 12 to project your monthly earnings.

To calculate your net income review your most recent 6 paystubs to find an average if your hours fluctuate.

STEP 3: ESTIMATE MONTHLY COSTS

Identify/Estimate the monthly cost of each expense. The exact amount is preferable for the bills category, but if you are not sure, review your previous month’s bank or debiting agency statements to complete this part.

FYI variable expenses are VARIABLE so you can just list an average based off your earnings, or an ideal $ amount.

STEP 4: DEFINE YOUR FINANCIAL GOALS

Define your financial goals for the upcoming year, 3 years-5 years AND assign target amounts for each goal!

The purpose of setting financial goals is NOT to discourage you but to motivate you to make smarter financial decisions and plan ahead. For instance, you may need to get a second job, work more hours, or reduce spending to achieve the goals you’ve set for yourself.

Some financial goal examples are: Saving $1000 for emergency fund by Dec 2025. Saving $650 for Christmas Presents by Dec 2025. Paying off $3500 in credit card debt by Dec 2027.

Calculate the amount you need per month to accomplish each goal by your designated deadline. Sum up all of the amounts and note it for step 5.

STEP 5: REVIEW & ADJUST

Now that you have a general overview of your finances AND you have set goals for yourself, lets punch in some numbers and goals (e.g. emergency fund, travel) into the designated category (e.g. saving, debt).

After, refer to the end of month balance at the top left. Is it positive or is it negative? Positive, great! You make enough to cover your monthly expenses + save. Negative? See if you can adjust some amounts in the variable expenses or debt payments.

Important Follow Up Questions When Reviewing & Adjusting

- Am I spending too much?

Yes: Cut down your personal spendings, dining out, subscriptions etc. Sacrifice unnecessary expenses to help you achieve your financial goals. Also, important thing to ask yourself: Are you living within your means?

No: Great! Make sure you are not living paycheck to paycheck & that you have enough funds to set aside for emergencies and pursue your goals (e.g. buy a house, go on a vacation). - Do I make enough to pay for all of my fixed expenses + daily necessities?

Yes: Wonderful! Ensure you’re not stretching yourself thin and you are living with your means. As in, you don’t need a credit card or loan to get by. You genuinely have enough in cash or in your checking to pay for your necessities + set some funds aside for emergencies.

No: Minimize your bills. Rule of thumb. Your bills should be no more than 50-60% and your daily necessities/personal expenses should be no more than 25-35%. Cut back on expenses you can actually cut back on. If you can find a cheaper place to live, that will definitely help your financial circumstance. You don’t need that expensive car to get you from point a to point b! Do you really need to buy coffee every morning?

STEP 6: EVALUATE YOUR PROGRESS

Evaluate Your Progress Monthly or Quarterly. I am the type to review and adjust my budget monthly. I find it easier to better prepare myself for the unexpected this way. The purpose of evaluating your progress is to see how well you’re staying on track with your financial goals. If you’re NOT doing well, it just means you need to tweak something in your budget plan.

DO NOT change up the whole thing, change one thing at a time until you have developed a plan you can actually stick to and still keeps you on track with your goals.

SIMPLE ANNUAL BUDGET SPREADSHEET

Take control of your personal finances, get a clear overview of your financial health and work towards achieving the life you desire.

USE CODE: 199LOVEBUDGET

this concludes how to create an annual budget that you can actually stick to!

I hope you now have a deeper understanding of budgeting and your own financial standing. Go and achieve your financial goals this year, knowing you are already taking the right steps toward a more secure financial future. You’ve got this!

If you need help creating a budget plan that works for you, email us at services@lovejasjoy.com. Name your subject line “I WANT TO UNDERSTAND MY FINANCES” and tell us your top 3 financial goals this year. We will get back to you within 1-2 business days! 😊

Please note we are NOT financial advisors, we are financial coaches. Our goal is to help you understand your finances and build a budget plan that works best for YOU. We will NOT sell you any third-party products or services. Our flat fee includes one on one session(s) PLUS resources needed for your financial journey.

love, Jas Joy

Other Posts You May Like

Related Topics

A Payday Routine: How to Budget Your Paycheck Like a Financial Expert