Mid-Year Financial Reset | Fix your finances in 7 days

Half the year is over and you know what that means…Mid-Year Financial Reset! Yay!

It is going to be a lot but very well needed. Don’t worry, we are going to get through it together step-by-step. This will be your financial reset plan that you can complete in a week or less.

If you are an individual or have a big family looking to assess and improve your finances quickly and efficiently, then this article is for you!

Look forward to daily tasks, mindset shifts, tools, and practical advice through this financial reset plan :).

As a personal finance educator (PS NOT the same as a financial planner/advisor), I am here to help you with your everyday money management needs.

LET'S GET INTO your 7 day mid-year financial reset plan!

Please note that this site contains affiliate links to products or services from third-party websites. Furthermore, we are not financial advisors. The information provided is for general informational purposes only and should not be considered as professional financial advice. By reading this post, you acknowledge and agree to the full terms of our disclaimer.

Table of Contents

“But remember the LORD your God, for it is He who gives you the ability to produce wealth, and so confirms His covenant, which He swore to your ancestors, as it is today.”

Deuteronomy 8:18 Tweet

Join our Personal Finance group!

Join us in achieving financial stability! Receive a wealth of practical tips, budgeting hacks, investment insights, and strategies to achieve your financial goals!

Why You Need a Mid-Year Financial Reset

My first question is, did you set financial goals for yourself at the beginning of the year, or at all? When I say goals, I mean did you write them down and create a plan for yourself to reach them? If not, you’re not being intentional! Not calling you out or anything, but it is the simple truth.

If you didn’t write them down or create a plan they are just thoughts & dreams.

If that is you, take some time to write down your money goals right now and ask yourself if the things you have been doing support those goals are not. Have you made progress, even just a little?

If not, that is what a mid-year financial reset is for! To catch and correct, or continue your course for the remainder of the year.

A financial reset allows you to make adjustments where needed, prep for what is to come and continue forth with what has been working for you.

The 7-Day Financial Reset Plan

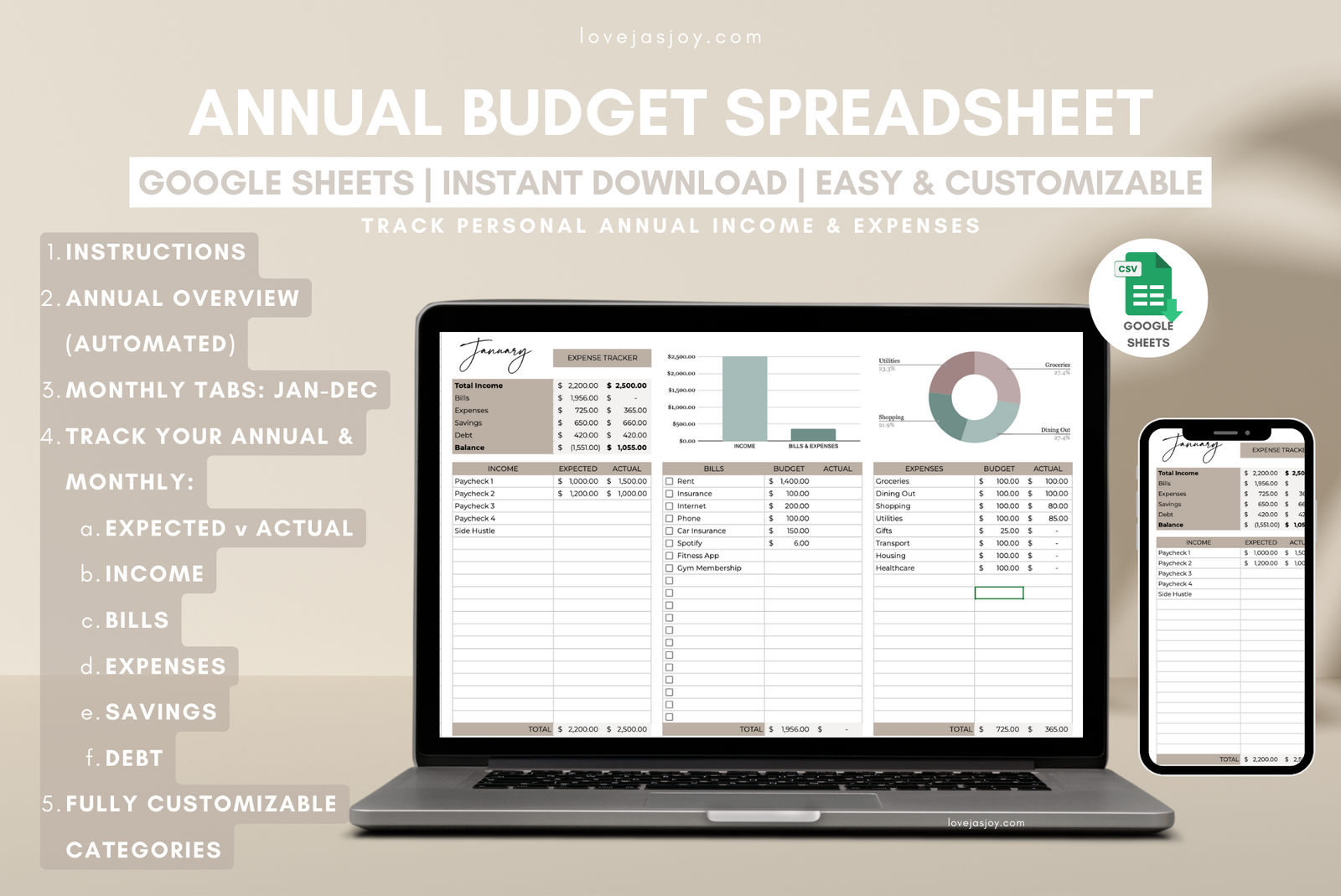

If you already budget your finances then the next 7 days will be simple, if you don’t then you will need to start from ground zero. I advise, just to make things simpler for yourself, to purchase a premade annual budget spreadsheet from etsy or from my store. Here are some budget sheets I think would be best to budget AND track your net worth:

- Minted Money Annual Budget & Goal Tracker:

- Use Code YOUTUBE50 for 50% OFF at checkout

- Priori Digital Studio Family Annual Budget Spreadsheet

- Use Code YOUTUBE60 for 60% OFF at checkout

- Love Jas Joy Annual Budget Spreadsheet

- Use Code RESET75% for 75% OFF at checkout

Financial Reset Plan Day 1

Day 1: Take Inventory

- Review your current financial status: Net worth, income, expenses, savings, debts, retirement, everything!

- Tools to Use: Budgeting apps, spreadsheets (my personal favorite), bank dashboard

- Get this Annual Budget Spreadsheet for 75% off from my store (Use Code: Reset75%)

- Download/Review recent bank and credit card statements

- Review your retirement balances

- Can do so through your employer portal and/or brokerage account (e.g. fidelity, vanguard)

Financial Reset Plan Day 1

Day 2: Analyze & Update Your Budget

- Compare actual spending vs. budgeted

- Identify and notate problem areas (overspending, unused/unwanted subscriptions, etc.)

- Adjust for next 6 months: seasonal changes, known expenses, insurance, car registration etc

- Choose a budget method (zero-based, 60/30/10 budget, envelope etc.)

Financial Reset Plan Day 1

Day 3: Set or Revise Your Financial Goals

- Short-term goals (3–6 months): Emergency fund, vacation savings, Christmas savings

- Medium/long-term goals (6+ months): Debt payoff, home purchase, investments

- Use the SMART goal framework: Specific, Measurable, Achievable, Relevant, Timely

- Create a vision board or goal-tracking dashboard: Pinterest, Journal

Financial Reset Plan Day 1

Day 4: Streamline and Cut Expenses

- Cancel unused subscriptions and renegotiate bills (phone, insurance, etc.)

- Contact your lender and/or credit card company to request a decrease in APR, if eligible

- Note, decreasing APR for loans may result in an internal refinance and may lead to a hard pull on your credit

- Call your insurance company(ies) to see if you are able to lower your plan’s cost

- Identify high-cost habits to tweak

- Automate savings where possible

- Into a high-yield savings, certificate of deposit, or recurring investment

- Use cashback/reward programs more effectively

- Only recommend utilizing credit cards if you are capable of paying it off at the end of every month. More debt is not worth the cashback/points!

Financial Reset Plan Day 5

Day 5: Tackle Debt Strategically

- List all debts with balances, interest rates, and minimum payments

- Choose a strategy: Debt Snowball vs. Avalanche OR play around with the numbers and see which order allows you to pay off your debt faster

- I personally do this with the debt calculator. Playing around with the numbers is best suited if you have car loan, student loan debt etc.

- Set up automatic payments or schedule paydown plan

- Consider refinancing or balance transfer options (if applicable)

- Balance transfers are best if you know you will pay off the card within that specific time frame due to balance transfer fees. BUT, to decide which option is best for yourself, compare how much in interest you will pay toward taking out a debt consolidation vs payments toward balance transfer fees throughout your desired term.

Financial Reset Plan Day 6

Day 6: Boost Your Income

- Review income sources and opportunities: Side gigs, freelance work, raises, second job, more hours

- Obtain certifications relevant to your career + request increase in income

- Update resume/LinkedIn if relevant

- Sell unused items for quick cash or consider working for DoorDash / UberEats

- Set a goal to increase income by X% by year-end or every so many years

Financial Reset Plan Day 7

Day 7: Automate, Plan, and Maintain

- Set up auto-payments, savings contributions, and calendar reminders

- Schedule monthly financial check-ins with yourself and your partner if you have joint finances

- Create a simple “financial dashboard” or summary sheet

- Celebrate your progress: Budget-friendly reward ideas, dine out, anything that will not put you deeper into debt or take you off course of your financial goals!

60/30/10 Budget Rule

Learn how to budget your money using the 60/30/10 budget method AND how it differs to the 50/30/20 and 70/20/10 rules.

TOOLS & RESOURCES

Financial Reset Tools & Resources

- Apps for budgeting (e.g., YNAB, Mint, Monarch)

- Debt payoff calculators

- Templates (goal tracker, budget sheet, net worth tracker). My favorites:

- LoveJasJoy Annual Budget Spreadsheet: Use Code RESET75% for 75% OFF

- PrioriDigitalStudio’s Annual Budgetsheet/Net Worth Spreadsheet: Use Code YOUTUBE60 for 60% OFF

- MintedMoney Annual Budget & Goal Tracker: Use Code YOUTUBE50 for 50% OFF

- TheWeeklyCrew Annual Budgetsheet

- Books, podcasts, or YouTube channels for ongoing learning

Final steps to stay on track

- Keep it simple! Don’t overcomplicate it or stress yourself out.

- Find an accountability partner! Your parent, friend, finance coach, significant other.

- Review your reset quarterly

- Give yourself grace and adjust when life happens 😊

this concludes the mid-year financial reset

There you have it! You have completed your Mid-Year Financial Reset!

Yes, it was or is a lot of work, but it is worth it 😊 Being able to know exactly where you stand financially is powerful. It may also be stressful, which is normal, but at least you’re not keeping yourself in the dark. You can formulate a financial plan, get the help you need if necessary, and take a step into the right direction.

Small consistent steps is all you need to build momentum. You do not need immediate BIG change to progress. Have confidence in your own abilities and if you don’t, get the help you need from a financial coach to assist you in your money journey.

Financial coaches are amazing at helping you understand the emotional components of dealing with money, they can assist in creating a budget and outlining a plan to manage your debt.

If you are unable to afford a fee-only based financial coach, then stay tuned with this website and social media channels! As a personal finance educator, I will provide you resources, money management tips & strategies, plus my own personal experience to assist you in your journey to the best of my ability :).

Talk to you in the next article 🤗 Until then, remember…

It’s not about riches, it’s about financial discipline and good stewardship over your money. Take control over your finances and confidently pursue the future you want for yourself!

love, Jas Joy

Other Posts You May Like

Related Topics

A Payday Routine: How to Budget Your Paycheck Like a Financial Expert