11 Smart Ways to Save Money in College Without Sacrificing Fun

Disclaimer

Please note that this blog post may contain affiliate links to products or services from third-party websites. The information provided in this blog post is based our own personal experiences, research, and opinions. By reading this blog post, you acknowledge and agree to the terms of this disclaimer. Read our full disclaimer page. If you have any concerns or questions, please feel free to contact us.

Saving money in college can be challenging! I am sure most of you have a part-time job that pays minimum wage or a little bit more than that. You feel like you don’t make enough money to save, but you’re wrong! Trust me, I was once where you are. Saving should be a top priority as soon as you get your paycheck. What is the point of working hard if you can’t save a portion of it for the future you’re straining on toward?

Yes, balancing academic expenses with social activities and personal needs may seem overwhelming, but with these smart money-saving strategies, you can enjoy your college years without seeing your total account balances at $0.00.

In this article, we will be spilling 11 practical ways that actually works to help you save money, without compromising the fun of being a college student!

WITH THAT SAID, HERE ARE 11 SMART WAYS TO SAVE MONEY IN COLLEGE WITHOUT COMPROMISING FUN!

Table of Contents

- #1 CREATE A BUDGET AND STICK TO IT + BEST BUDGET PLANNERS

- #2 CREATE SEPARATE ACCOUNTS AT YOUR PRIMARY BANK

- #3 CREATE A SHOPPING LIST + COOK AND MEAL PREP

- #4 BRING YOUR STUDENT ID EVERYWHERE FOR STUDENT DISCOUNTS

- #5 SHARE EXPENSES WITH ROOMMATES

- #6 AVOID NEW TEXTBOOKS. BUY USED TEXTBOOKS OR RENT

- #7 LIMIT IMPULSE SPENDING

- #8 OPT FOR FREE OR LOW COST ENTERTAINMENT

- #9 FIND PART-TIME WORK, PAID INTERNSHIPS, SIDE HUSTLES

- #10 SAVE ON LIVING EXPENSES, UTILITIES

- #11 APPLY FOR FAFSA, SCHOLARSHIPS, GRANTS + ALTERNATIVES

The wise man saves for the future, but the foolish man spends whatever he gets.

Proverbs 21:20 Tweet

Join our "Love money Scoops" group!

Join us in achieving financial stability! Receive a wealth of practical tips, budgeting hacks, investment insights, and strategies to achieve your financial goals!

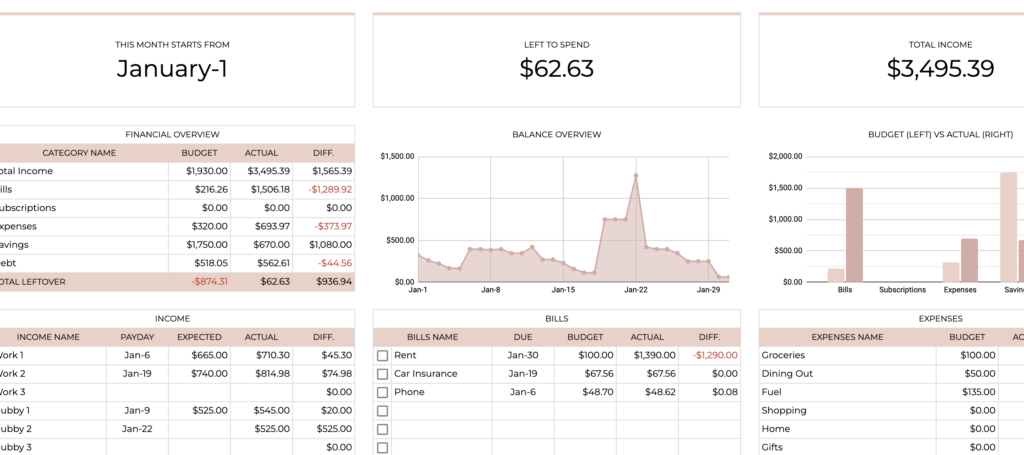

#1: CREATE A BUDGET AND STICK TO IT + BEST BUDGET PLANNERS

As an employed college student, you may think you need to stick to the “budgeting guidelines” of 50% Needs, 30% Wants, and 20% Savings. But being completely transparent, that is an unrealistic budget guideline to follow as a full-time student. Why? Unless you are working full-time, or have little to no bills, you probably do not make enough to save 20% of your earnings.

Realistically, 85% pays for our needs, 13% pays for our wants and the remaining 2% is what we have left to save. As a person who was in that position before, it can feel discouraging to save at all. BUT I am telling you, keep saving based on what you have NOT what you wish you had. Every penny counts, and if that is all you have left, then save it!

Develop a clear and realistic budget for yourself. Budget Planning 101:

- Outline your expected monthly net income (after tax deductions)

- Prioritize your fixed expenses: rent, phone, tuition etc

- Set a weekly spending budget: groceries, leisure

- Remember to live within your means!

- Save what you have left AS SOON AS you get paid

- Save per paycheck. If you budgeted accurately, you will not need to worry about not having enough to pay for your bills.

- Bill > Savings > Spendings

Invest in a budget planner to help you keep track of your expenses, savings, and spendings. Personally am in love with Etsy’s Digital Budget Planners and Amazon’s Wide Variety of Budget Planners available. Here are a couple that I have purchased before:

#2: CREATE SEPARATE ACCOUNTS AT YOUR PRIMARY BANK

It is recommended to have distinct, separate accounts to improve money management: one for bills, one for your spendings, and another for savings.

I still adhere to this strategy and it has always helped me to maintain an accurate overview of my financial standing: The remaining spendable amount I have and my outstanding bills still yet to be paid.

Utilizing this strategy will prevent you from dumping all of your funds into one account, falsely leading you into believing it is free to spend. This ensures smart savings and disciplined spendings! Vice versa.

Budgeting Tip: If you are able, set up automatic transfers per pay period to your bill, spending and saving accounts. This keeps you from spending impulsively and helps form the habit to pay yourself first.

#3: CREATE A SHOPPING LIST + COOK AND MEAL PREP

Monitor your spendings! Treat yourself to a restaurant meal every once in a while, but avoid doing so more than once a week. Continuously eating out depletes your funds substantially AND it is not the most healthiest choice either.

Instead, create an affordable shopping list for yourself, prioritize meals over snacks: meat, grains, fruits, vegetables, starch. Learn to cook simple, nutritious meals and consider meal prepping to save both time and money.

BudgetBytes has helped me save money by inspiring my affordable grocery list and meals.

Costco is one of the best stores to shop in bulk, which is recommended for cost-effectiveness. But if you can’t afford It, then a grocery store will be ideal. For instance, Trader Joes.

If you are a coffee lover and you buy coffee every morning, consider saving up for a coffee machine instead. Limit your coffee spendings for a while and put that extra money into investing in a keurig, nespresso or an electric kettle. You will save hundreds of dollars a year by doing so.

#4: BRING YOUR STUDENT ID EVERYWHERE FOR STUDENT DISCOUNTS

Take advantage of student discounts whenever possible. Numerous retailers, entertainment venues and restaurants offer special rates, deals or discounts for college students. With that said, always carry your student ID around. Do not be shy to ask if discounts are available! Less money to spend = more money to save.

#5: SHARE EXPENSES WITH ROOMMATES

Whether you’re living on or off campus, communicate with your roommates on what you can split payments for. Eating out, entertainment, rent, utilities, and internet. Sharing the financial burden will release a lot of worries from you and your roommates.

#6: AVOID NEW TEXTBOOKS! BUY USED TEXTBOOKS OR RENT

New textbooks can be incredibly expensive, BUT you can save hundreds by purchasing used ones or renting. In college I only purchased a couple of new textbooks because it was required, the rest I purchased used, rented or received a hand me down.

Conduct your research by exploring online marketplaces, campus bookstores for better deals. Tip: Always double check to make sure the book you’re looking at has the same ISBN as the one you need.

Couple of students favorites to shop for better book deals:

#7: LIMIT IMPULSE SPENDING

Avoid spending impulsively! It is good to treat yourself, but do your best to not make it a habit often if you know you can use the money more wisely.

Ideally, waiting 24 hours before making a big purchase will help you determine if it’s truly necessary or if you actually want it.

#8: OPT FOR FREE OR LOW COST ENTERTAINMENT

College campuses often offer free or low-cost events, such as move nights, workshops, concerts and food festivals. Take advantage of these opportunities for fun without digging a hole into your pocket. Utilize student discounts for entertainment, such as hulu + spotify.

#9: FIND PART-TIME WORK, PAID INTERNSHIPS, SIDE HUSTLES

It may be difficult to study and work simultaneously, but it is not impossible. You need to do all that you can for yourself, you are capable of everything you put your mind into.

Contemplate finding part-time work on or off-campus to earn money consistently. Consider paid internships, you will be able to reap the benefit of hands-on experience in your career field and a paycheck. Look for additional side hustles, such as: babysitting, dog walking, yard work. Alternatively, explore freelancing opportunities that align with your skills and interests!

Some great freelancing sites:

#10: SAVE ON LIVING EXPENSES, UTILITIES

If you plan on living off campus, seek after affordable housing programs or aim for cheaper places to rent. Additionally, consider trustworthy roommates to live and split payments with.

When living off campus, it is important to conserve energy and water to reduce utility bills. Unplug everything before you leave the house for the day and sleep at night, turn off lights when not in use, take shorter showers to save on water heating costs, purchase LED lights and more. There are numerous ways to conserve. It is good for your wallet AND environment.

11 Financial Tips You Need to Know for College

#11: APPLY FOR FAFSA, SCHOLARSHIPS, GRANTS + ALTERNATIVES

Applying for FAFSA is a must! The government provides student loans and/or pell grants based on your estimated family contribution and financial needs.

Scholarships are also available to you year round. Continuously search and apply for every scholarship and grant that matches your interests and academic achievements. Doing so can help alleviate some financial weight off your shoulders and reduce the need for student loans.

Other alternatives, crowdfunding, free tuition, online education and more. Read our post on 11 Financial Tips You Need to Know for College, to get insight on some opportunities available to you!

Saving money in college doesn’t have to mean sacrificing fun. College budgeting, student discounts, cooking, meal prepping and the rest of these strategies can help you manage your finances responsible while enjoying a fulfilling college experience. Remember, small changes in your spending habits can make a significant difference in the long run. So, act on these money-saving tips and make the most of your time AND money!

love, Jas Joy

Other Posts You May Like

Related Topics

A Payday Routine: How to Budget Your Paycheck Like a Financial Expert