How to Stop Overspending: 7 Practical Tips to Spend Smarter

Hopefully, you can find comfort in knowing that you are not alone. Overspending is a common problem that affects millions of people worldwide! From impulsive spending, failing to monitor your expenses regularly to dining out more than you should, overspending can push back your financial goals and cause unnecessary stress.

The good news is, there is light at the end of the tunnel! With some effort and time (to give yourself grace), you can take control of your finances with simple yet effective strategies.

In this article, we’ll explore how to stop overspending and share 7 money hacks that actually work to help you spend more consciously and intentionally.

let's get into 7 Money Habits to Stop Overspending and Spend Smarter

Please note that this site contains affiliate links to products or services from third-party websites. Furthermore, we are not financial advisors. The information provided is for general informational purposes only and should not be considered as professional financial advice. By reading this post, you acknowledge and agree to the full terms of our disclaimer.

Table of Contents

“But remember the LORD your God, for it is He who gives you the ability to produce wealth, and so confirms His covenant, which He swore to your ancestors, as it is today.”

Deuteronomy 8:18 Tweet

Join our Personal Finance group!

Join us in achieving financial stability! Receive a wealth of practical tips, budgeting hacks, investment insights, and strategies to achieve your financial goals!

Why Do People Overspend?

Before we dive into solutions, it is important to understand why we tend to overspend. Some common reasons include emotional spending (e.g., form of distraction, denial, happiness), lack of budgeting, unawareness of your own financial health, peer pressure, and overall having poor financial habits.

Recognizing these triggers and owning up to them is the first step to helping yourself address the root cause and make lasting changes.

7 Money Hacks to Stop Overspending Today

Stop Overspending & Spend Wisely Money Tip #1

Create a Realistic Budget and Stick to It

The word “budget” is not everyone’s favorite word. It is often associated with restriction and lack of freedom. It also makes some people feel more financially stressed because the reality of their standing sets in.

But budgeting is essential to the foundation of good financial management!

Build the habit of tracking your income and expenses monthly and setting clear spending limits for categories like groceries and entertainment. Doing so will increase your financial awareness, help track your progress toward your goals, reduce debt, prevent overspending, increase saving and overall enhance smart financial decision making.

Learn How to Budget & Automate Your Money: 60/30/10 Budget Rule

Tips to Simplify the Budgeting Process and Stay in Control of Your Money:

- Enroll in mobile banking if your bank offers it.

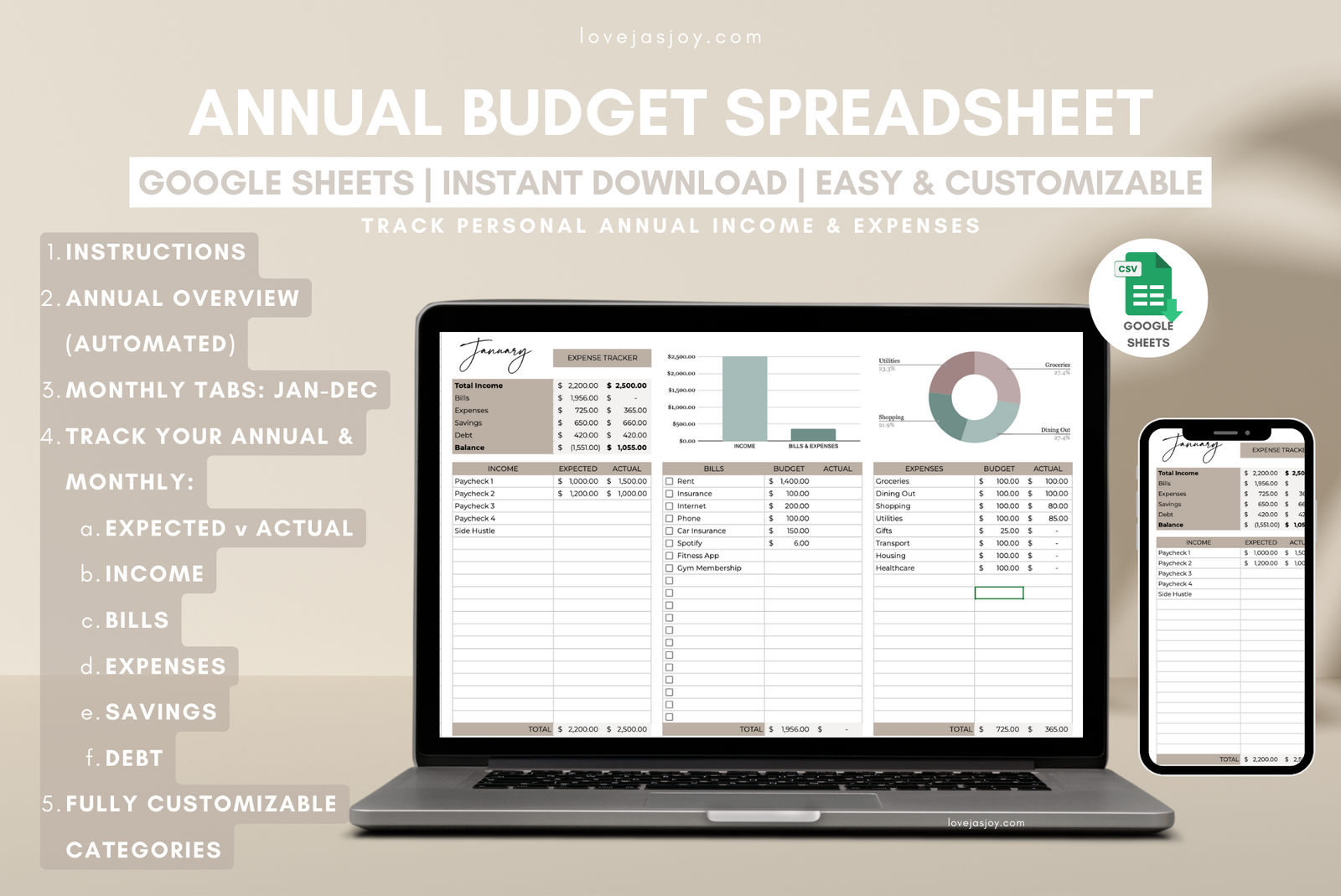

- Get yourself an affordable annual or monthly budget spreadsheet template from Etsy or my shop.

- Download free budgeting apps like Mint or YNAB.

Stop Overspending & Spend Wisely Money Tip #2

Use the 24-Hour Rule for Purchases

We all fall victim to impulse spending every now and then. Some more than others. You know yourself better than anyone else, so if you find that 24 hours isn’t long enough to cool off then extend it to 3-7 days.

This cooling-off period helps you evaluate whether you really need the item or if it’s just a fleeting desire. It also gives you time to figure out the opportunity cost of purchasing the item vs not.

Stop Overspending & Spend Wisely Money Tip #3

Separate & Automate Your Savings & Spendings

Separating your spending money from your bills and savings can greatly reduce the stress of managing your finances. This is why Step 1 creating a realistic budget is so important, it will help you understand where your money is going and how much is coming in.

Before you transfer any money into your spending or savings accounts, you need to know exactly how much is required for bills and necessities.

Learn How to Budget & Automate Your Money: 60/30/10 Budget Rule

Once your essentials are covered, you can allocate the remaining funds into categories like savings, spending, and a buffer for unexpected costs.

For example, if you have $500 left after paying your bills, you might set aside $100 as a buffer. That leaves $400 to divide between savings and spending. If your goal is to save 20%, you’d transfer $80 to savings and the remaining $320 to your spending account.

Automating these transfers as soon as you get paid can help you stay consistent and reduce financial stress. Always aim to prioritize saving over spending, and be flexible—some months you might be able to save more, while others may require a bit more spending. Adjust your percentages as needed to stay aligned with your financial goals.

Stop Overspending & Spend Wisely Money Tip #4

Limit Credit Card Usage

Credit cards can be good or bad depending on how you use it. Most often, it encourages overspending since you don’t feel the immediate impact of the purchase. Instead of turning to a credit limit, try using cash or debit cards for daily expenses to keep your spending in check.

Rule of thumb, if you are not able to pay off the credit card right away or by the end of the statement period, then avoid using it. This can be a sign of overspending!

If truly you find it difficult to cover essentials without a credit card, consider speaking with a personal finance counselor (may be free via certain banks/churches or fee based for third party). They can assist with creating a budget and spending plan that works best for you!

PS, feel free to email me at services@lovejasjoy.com if you need a personal finance counselor. Just FYI, there is a fee for consultation.

Are you doing well financially?

Stop Overspending & Spend Wisely Money Tip #5

Identify and Cut Unnecessary Subscriptions

Monthly subscriptions can quietly drain your budget! Especially if you are not using it, it would be a waste of money.

Review your subscriptions regularly—streaming services, gym memberships, apps—and cancel those you don’t use or need. This simple step frees up money for more important expenses or savings.

If you are willing to sacrifice one or a couple, do so! For myself, I only keep one streaming service at a time. Once I get bored with it, I cancel it and subscribe to a different streaming service.

For example, I activate my Netflix subscription for July-September, deactivate it for October-December, and activate Hulu for October-December. This ensures I am making the most out of one streaming service while not unnecessarily wasting money on another.

Stop Overspending & Spend Wisely Money Tip #6

Wise Grocery Shopping and Dining Out

Eating out frequently adds up fast. It’s important to enjoy your money, and if dining out brings you joy, who am I to tell you to stop? The key is to set clear spending limits for both groceries and eating out so you can indulge without guilt or financial strain.

Start by finding a balance between dining out and cooking at home. Let’s say you have a monthly food budget of $700. Decide how much of that you’re comfortable spending on restaurant meals but be realistic. For example, if a month’s worth of groceries—covering three meals a day plus snacks—costs around $500, that leaves you with $200 for dining out.

If you want to increase your dining-out budget, you’ll need to tighten your grocery spending. That means sticking to a strict meal plan, shopping smart, and choosing affordable ingredients.

A huge money waster is buying food you can’t finish or are unlikely to consume regularly. To reduce waste and maximize your budget, buy foods you know you enjoy and can commit to when meal planning.

Consistency is key!

Meal prepping, using leftovers creatively, and shopping with a list can help you stay on track. Over time, you’ll find a rhythm that allows you to enjoy both home-cooked meals and the occasional treat out—without overspending.

Stop Overspending & Spend Wisely Money Tip #7

Set Financial Goals and Track Progress

Having clear financial goals motivates you to stick to your budget. Whether it’s saving for a vacation, paying off debt, or building an emergency fund, track your progress monthly.

Explore Some Short-Term Financial Goals You Can Set & Successfully Achieve

Be sure to celebrate small wins to stay motivated and avoid overspending! Continue encouraging yourself even during times you may feel like you’re not progressing. The right mindset will get you to where you want to be.

More Finance Tips & Mindset Shifts to Smarter Spending

More Money Tips to Spending Smarter

- Practice gratitude daily! Be grateful for what you have and steward it wisely

- Luke 16:10 Whoever can be trusted with very little can also be trusted with much.

- Review your budget routinely (e.g. weekly, monthly).

- Carry only cash for small purchases, personal spending or dining out.

- Make a realistic spending and grocery list that you can stick to.

- Unsubscribe from tempting marketing email lists.

- Avoid Browsing & Delete your shopping apps (e.g., amazon, etsy, starbucks) .

- Keep a daily habit tracker for “No Spendings.”

- Review your financial goals regularly to keep your mindset on track.

- Practice mindful spending by asking yourself if a purchase aligns with your values.

- Avoid shopping when you’re stressed or bored, as emotional spending leads to regret.

- Surround yourself with financially responsible people who support your goals.

FAQs About Stopping Overspending

Q: How long does it take to break overspending habits?

- A: It is subjective, but most people see improvements within a few months of consistent budgeting and mindful spending. Consistency is key!

Q: Can I still enjoy life while cutting spending?

- A: Absolutely! Smart spending means prioritizing what matters most to you and cutting out wasteful expenses. A Book Recommendation I have for you that promotes Conscious Spending and Wise Money Management: I Will Teach You To Be Rich by Ramit Sethi.

Q: What’s the best resource to track spending?

FINAL THOUGHTS

How to Stop Overspending for Good

Stopping overspending is NOT about depriving yourself—it’s about making intentional choices that improve your financial health!

Implementing these 7 money tips will help you take control over your spending habits, build savings, and reduce money-related stress.

Begin building good financial habits one wise decision at a time, and I can ensure your financial standing will improve!

Love,

Jas Joy

Other Posts You May Like

Related Topics

A Payday Routine: How to Budget Your Paycheck Like a Financial Expert